I’ve always had a serious problem with the state of cryptocurrency exchanges. It’s baffling that the only place you can trade digital currencies that were designed to be a decentralized, peer-to-peer mean of money transfer, is a centralized exchange. So, essentially, they control my digital money that’s only meant to be controlled by me.

But things are changing. Back in the first editions of this blog I’ve played around with the Waves’ DEX, a decentralized exchange that used smart-contracts for pairing users’ buy and sell orders. Overall, it was an OK experience, but I hated how the exchange is literarily shoving WAVES tokens down users’ throat at every other click of the mouse, so I left it.

Since then, I’ve praised Binance’s token distribution model on several occasions. It’s super simple and yet effective - use our tokens to pay fees and get discounts. Now, Binance has launched a demo of their own decentralized exchange, with the Beta version being poised for release sometime at the beginning of 2019. I’m very excited about it.

I’m not saying there are no decentralized exchanges out there, I just don’t really trust most of them and Binance is just way too convenient. This week though, I found out about StellarX. As is evident from the name, it’s Stellar’s very own decentralized exchange, and, wait for it, it’s supposed to be completely fee-less. As in, totally free to use. Nothing gets me as excited as literarily anything that’s free. So, naturally, I wanted to check it out.

Just what I expected. I fired up my trusty VPN and voilà - I’m in.

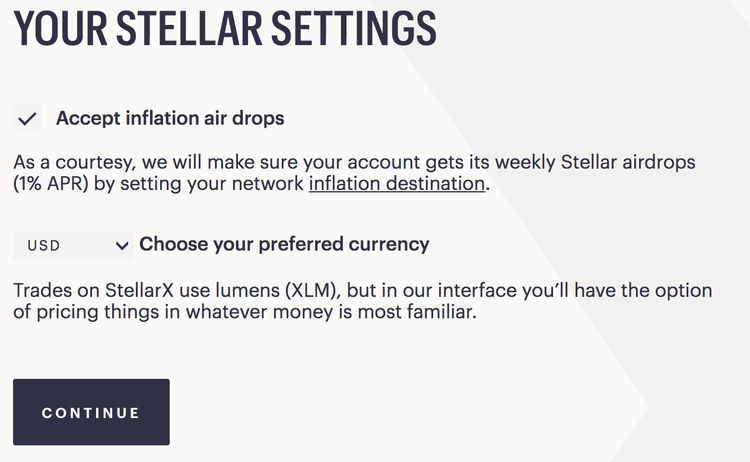

It looks nice. They promise all kinds of assets and not just cryptocurrencies (not that I’ll ever be able to wrap my head around securities, bonds and all that). They also refund network fees and inflation for holders of their tokens. And there are some weekly airdrops, so I’m actually tempted to get some lumens.

Here are some more screenshots:

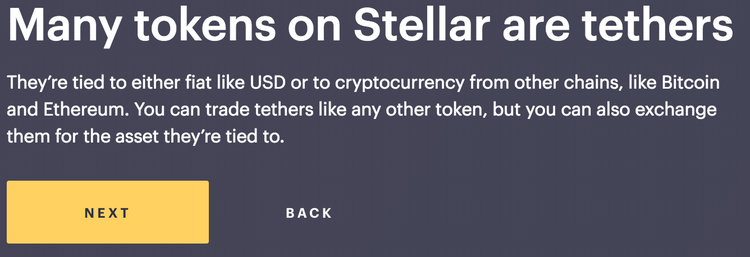

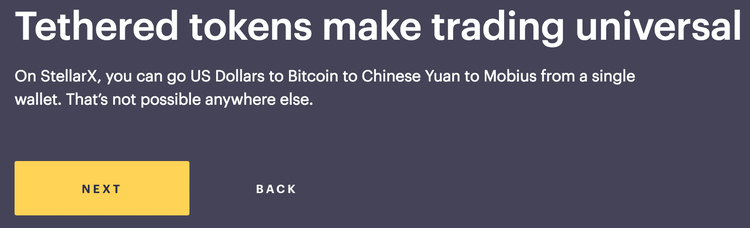

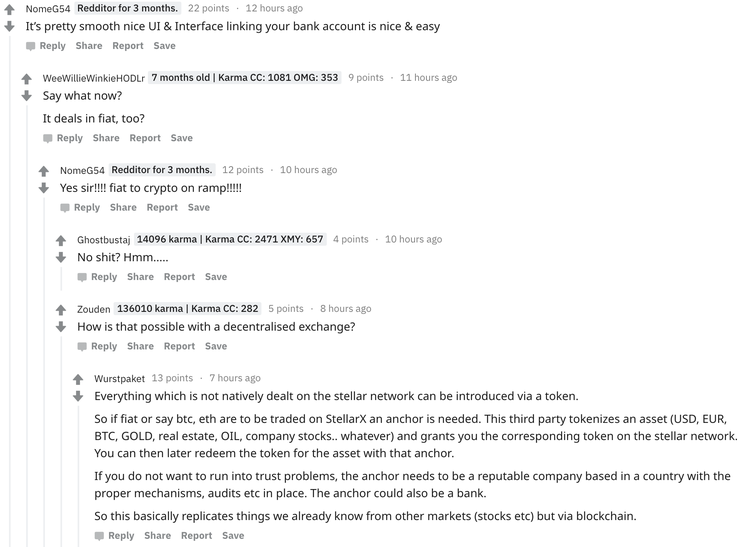

So it seems that they’re trying to bridge the gap between fiat and crypto. Here’s some more exciting info about it so that I don’t have to type it all out:

Looking around the exchange I’ve noticed they give you an option of using your email address as a ‘human-readable alias for your Stellar public key’. That’s exactly the kind of thing cryptocurrencies need to do to bring mass-adoption even closer.

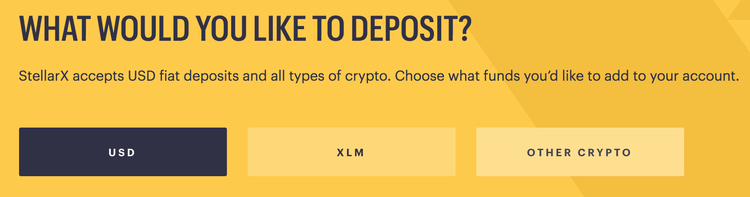

Here’s what we have in terms of deposit options:

For USD deposits they’ve partnered up with some guys called AnchorUSD. The minimum deposit is $1000, you’ll need to provide some basic ID information and pay a flat fee of $25 to AnchorUSD. XLM option is pretty self-explanatory, as for ‘Other Crypto’ - they use Changelly, so the standard 0.5% fee is to be expected.

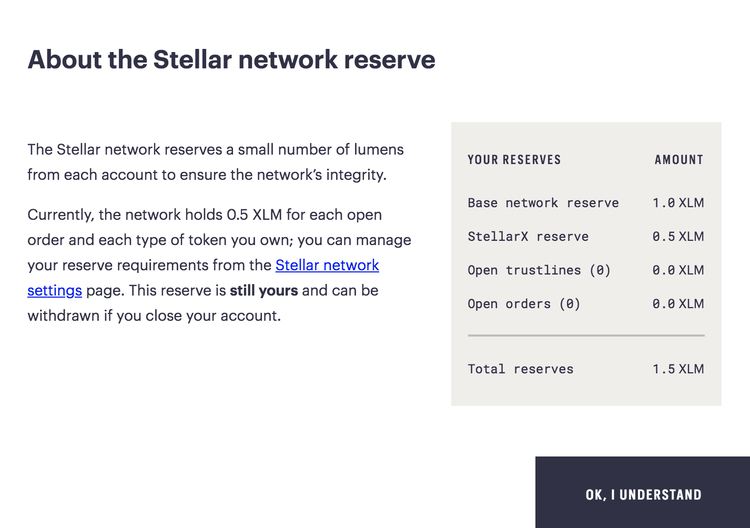

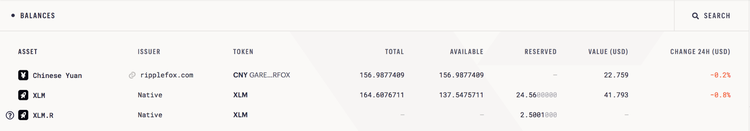

As I currently have most of my crypto in BNB and I’m waiting for the burn they’re supposed to have soon, I went on LocalBitcoins and got myself 0.01 BTC. The transfer took a little under 20 minutes, which I guess is okay. I’m now a proud owner of 254 XLM, but StellarX ‘reserved’ a tiny bit of them for the purposes I don’t really fully understand. I pressed ‘OK, I UNDERSTAND’ but I didn’t really, hope they’re not spending it on booze, otherwise i’d ask for my share! But moving on...

So, there are no trading fees but the more you use this DEX and the more tokens you get the more tokens you’re giving up, albeit temporarily? So, not actually fee-less, eh?

Admittedly, this exchange has very, very low trading volume. Maybe I just got used to Binance volumes, but still. This is actually rather interesting, because the three top tokens in terms of 24 hour volume on this exchange are tokens I’ve never even heard of.

RepoCoin is a weird, weird one. They’re putting the auto lending and repossession industry on the blockchain. I, for one, didn’t even know that industry exists. Their Twitter account hasn’t been active since May, 2018. Rather coincidentally, April 30th was the end-date for their ICO. They do have a subreddit that no one reads. Of course, they’re posting things like ‘Join Repo Coin in Telegram and stay updated with the strongest crypto community in the world’ and ‘Join the most promising ICO of 2018 and be a part of revolution!’ Blah Blag - Big Ass Red flags galore.

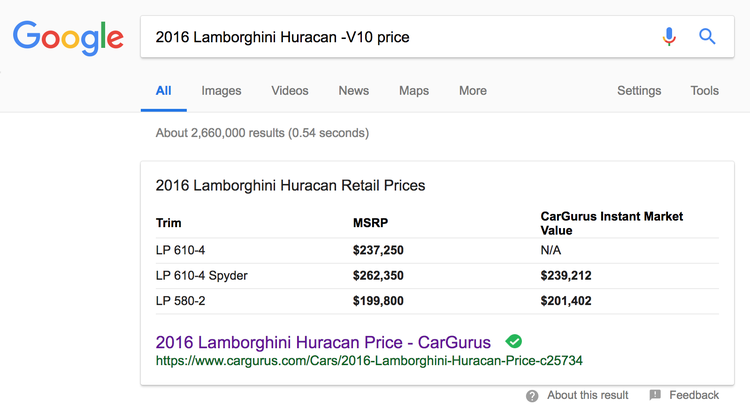

They’ve also made damn sure their tokens were actually useful. You can buy things with them! For instance, you can get a 2016 Lamborghini Huracan for just 5,000,000 Repo Tokens. They’re priced at $0,105, so that’s roughly $500,000. Just out of interest, how much will a 2016 Lambo be if I used something a slight bit more legitimate, like a U.S. dollar?

What else do they have in their store? There’s an iPhone X for 20,000 tokens ($2,000), a $50 Starbucks gift card for 1000 REPO (100$) and a PlayStation 4 for 8,000 tokens. It seems that most of their prices are normal retail price times 2. I guess you have to pay a double price for the privilege of ‘redeeming’ something for a crypto-token. To be fair, that’s a great retail model, need to sleep on that idea!

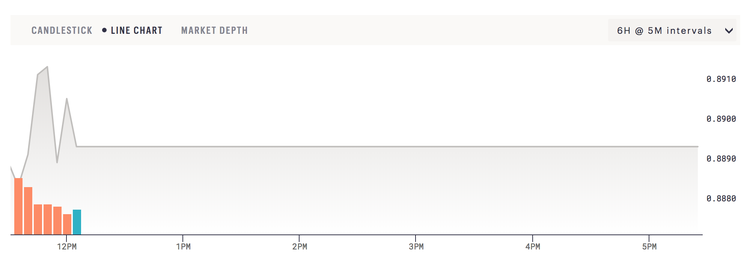

So why was there so much trading activity? Well, the ‘recent trades’ tab looks just about as suspicious as it gets. This was either a pump-and-dump or someone was just getting rid of a dead asset. That’s a no from me.

Then, there’s Glitzkoin which is not even listed on Coinmarketcap. The company is going to integrate ‘the latest blockchain technology into the diamond industry supply chain’. Apparently, this month they’re going to open their DiaEx, which is a diamond exchange. Well, all the best to them, but look at just how depressing this trading chart is!

Also, if you think that a Diamond Exchange is niche, it’s actually nothing compared to what the Atlantis Blue Digital Token was created for. Ranked 1674th on Coinmarketcap, with an impressive history of its market capitalization being at exactly zero, always, this token can be exchanged for ‘one of the rarest gems in our planet - Larimar’. I gotta admit, the stone looks cool.

But the exchange itself has been extremely disappointing so far. The only coin that it actually actively trades is a shitcoin scraped right off the very bottom of the barrel. So, I just bought some Chinese Yuan. Here’s my portfolio so far. I placed a market price order and it was only filled after an hour or so. Also, the exchanged glitched a couple times sending me notifications saying my order was partially filled, when in reality it wasn’t.

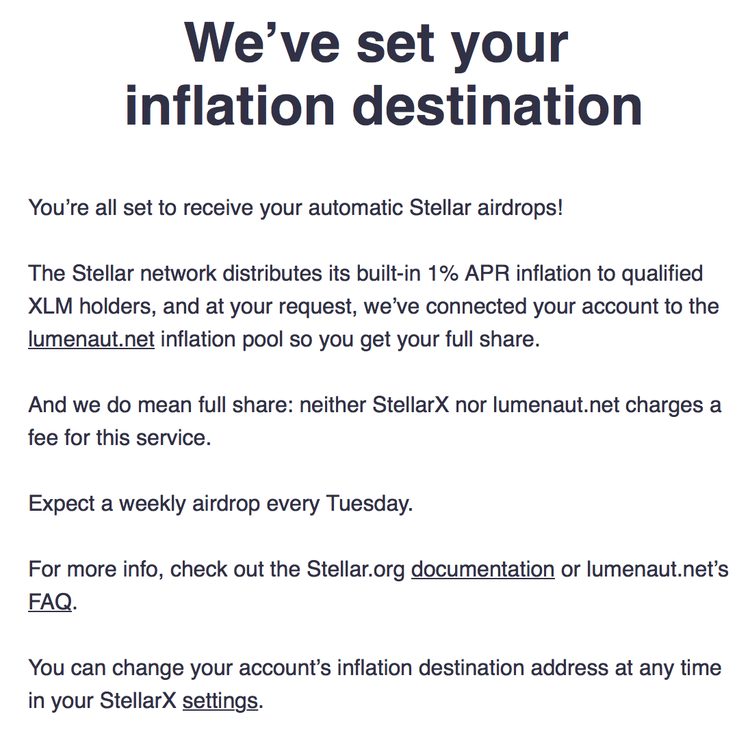

Around the same time I received this email from StellarX:

While weekly airdrops sound nice, one line here caught my attention: ’at your request’. I have never requested that to be done, but alright.

I get that it’s far too early to judge this exchange, but I haven’t enjoyed it at all, to be honest. There’s nothing happening, it’s not actually fee-less, the top trading tokens are just horrible and they are there purely because they held ICOs on the Stellar blockchain. It’s great that this platform is decentralized, but other than that there’s nothing to it, at all.

I do have high hopes for Binance’s decentralized platform and as I’m writing this I’m contemplating whether to move all my XML tokens over to the centralized Binance. I just don’t see myself using StellarX on the daily basis, at least for now.