After the testing stage of the xRapid product from Ripple, three payment systems began its commercial use, according to the head of the blockchain project from San Francisco, Brad Garlinghouse. The international payment systems MercuryFX and Cuallix have already tested the new technology, and the Catalyst Corporate Federal Credit Union has become a new partner of Ripple.

xRapid is going into commercial production. @mercury_fx_ltd, @Cuallix and Catalyst Corporate Federal Credit Union will be the first to make on-demand cross-border payments on RippleNet using #XRP. https://t.co/dQ02J4vdBl

— Ripple (@Ripple) October 1, 2018

MercuryFX specializes in international payments, Cuallix performs settlements between the United States and Mexico, and the Catalyst Corporate Federal Credit Union provides financial services to about 1,400 credit unions, mainly in the western and southwestern regions of the United States. Ripple senior vice president Asheesh Birla added that other companies that previously tested xRapid, such as Western Union, Money Gram, Viamericas and IDT, are not ready to start working with it at the moment.

The main feature of xRapid is the use of the XRP token. The solution is focused on payment providers and financial institutions seeking to improve user experience and minimize costs in making cross-border payments, as well as to increase the speed of the latter. Sagar Sarabhai, head of regulatory relations for Asia-Pacific and the Middle East at Ripple said in September that the full launch of xRapid could take place in the near future. And the results of the first pilot projects using the XRP token and xRapid technology were presented in May of this year.

What is xRapid?

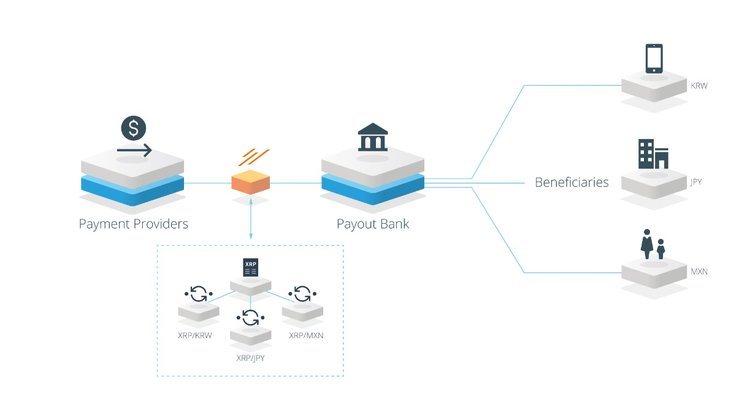

xRapid is a Ripple solution for real-time cross-border transfers using XRP as a binding currency. The platform was designed to speed up international payments. Due to the liquidity and technological features of XRP cryptocurrency, the service allows you to make transactions faster and cheaper than it happens in traditional payment systems.

For example, a client wishes to transfer $50 million in euros to a recipient, to whose account U.S. dollars will be credited. In this case, $50 million in euros are exchanged for XRP at the market rate. Then, via the blockchain, the money is transferred to the wallet of the exchange that serves the recipient’s account, where cryptocurrency is exchanged for fiat, which is then credited to the recipient’s account through local payment channels. The whole process takes 3-7 minutes depending on the specific conditions of the sender and the recipient. The part of the transaction in which the cryptocurrency is involved takes 4 seconds, which makes it possible to reduce the risks of volatility to a minimum.

xRapid will use financial companies or corporations that don’t accept current conditions for sending funds that take 3 to 5 days and need to make quick payments. Both sides of the transfer must be connected to the Ripple system using the developed APIs. Spreads used in the conversion will be as low as possible. On average, each transfer in the xRapid system will be 40-70% cheaper than SWIFT transfers.

The project started in May. The financial institutions that participated in the tests were able to save from 40% to 70% compared to the costs they incurred using the services of traditional providers. The average transaction time was slightly more than two minutes, while the usual international bank payment takes 2-3 days. At the same time, the operation with the XRP Ledger network takes only 2-3 seconds, while the rest of the time is spent on additional processing by third parties in the face of exchanges and local payment services.

“The exchange rates were very competitive, and the transaction times were unbelievable. It was lightning fast compared to using the correspondent banking network Swift,” said Alistair Constance, director of Mercury FX, which participated in one of the pilots.

It is worth noting that while the news has not had a positive impact on the cost of XPR. Over the past day, the average market price of the token has decreased by 4%, now the cryptocurrency is trading at $0.56.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.