A special Independent Financial Technology Task Force to combat the use of cryptocurrency for terrorist purposes will be established in the United States. The U.S. House of Representatives adopted a corresponding bill.

In January 2018, a member of the Financial Services Committee, Ted Budd, presented his bill, according to which compensation would be provided for providing information on the financing of terrorism using cryptocurrency.

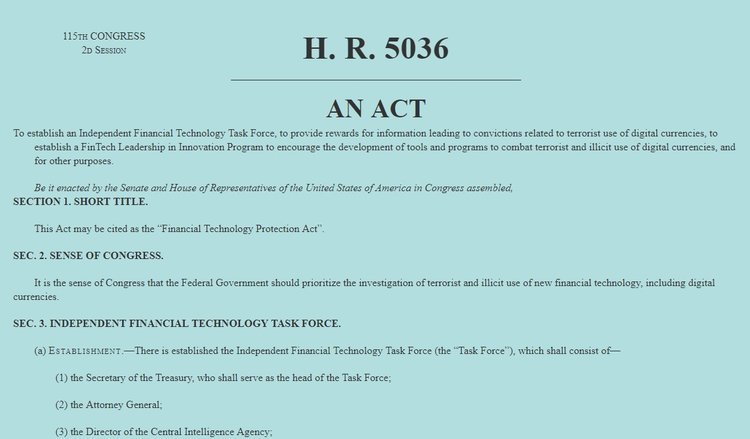

The resolution of the House of Representatives (HR) 5036 is a slightly modified version of the bill proposed by Budd. As a result, the Independent Financial Technology Task Force will be created to combat the illegal use of the cryptocurrency. However, the new version of the draft law sets the same time frame for reporting on the potential use of cryptocurrency in non-core activities. As a result, the Task Force should submit its findings no later than one year after the effective date of the draft law.

The section “Preventing Rogue And Foreign Actors From Evading Sanctions” was added to the bill. Now the regulatory authorities will be obliged to report not later than 180 days after the adoption of the draft law on the potential use of crypto technologies as a means of avoiding sanctions, financing terrorism or money laundering. The bill also contains the procedure and rules of remuneration for helping to provide information leading to convictions involving the use of digital assets for terrorist purposes. The resolution says that the amount of remuneration will not exceed $450,000.

Earlier, the U.S. House of Representatives approved the bill "FinCEN Improvement Act". The legislation requires that The Financial Crimes Enforcement Network (FinCEN) ) works with foreign financial intelligence units to prevent the use of virtual currencies that potentially can be used by terrorist groups for illegal activities and money laundering.

"Although the use and trading of virtual currencies are legal practices, some terrorists and criminals, including international criminal organizations, seek to exploit vulnerabilities in the global financial system and are increasingly using emerging payment methods such as virtual currencies to move illicit funds," the bill says.

At the same time, the Financial Services Committee of the U.S. Congress refuted the theory that the cryptocurrencies can now be used by terrorist organizations as a financial instrument. The Office concluded that attempts by terrorist organizations to use digital assets as a means of transferring funds within organizations did not yet have much success.

Yaya J. Fanusie is the director of analysis for the Foundation for Defense of Democracies’ Center on Sanctions and Illicit Finance (CSIF), believes that this is due to the fact that most terrorists, especially "jihadists" currently live in conditions where there simply are no conditions for transferring the cryptocurrency. Their criminal activities require significant financial resources and anonymity, so terrorists could resort to using crypto as a way of performing settlements that meet their requirements, but often they are located in technologically backward regions.

At the same time, Fanusie adds: “By preparing now for terrorists’ increasing usage of cryptocurrencies, the U.S. can limit the ability to turn digital currency markets into a sanctuary for illicit finance.”

Therefore, the expert recommends that authorities focus on small crypto exchanges that sell alternative tokens or instead of major exchanges that have already accepted AML and KYC conditions in the last few years.

Subscribe to our Telegram channel to stay up to date on the latest crypto and blockchain news.