Bitmain is the world’s biggest cryptocurrency mining equipment manufacturer. Recently, the company submitted an Application Proof for IPO at the Stock Exchange of Hong Kong, Techcrunch has reported.

Most of the document is redacted; Bitmain’s fundraising goal is still unknown, however, growth numbers are quite interesting.

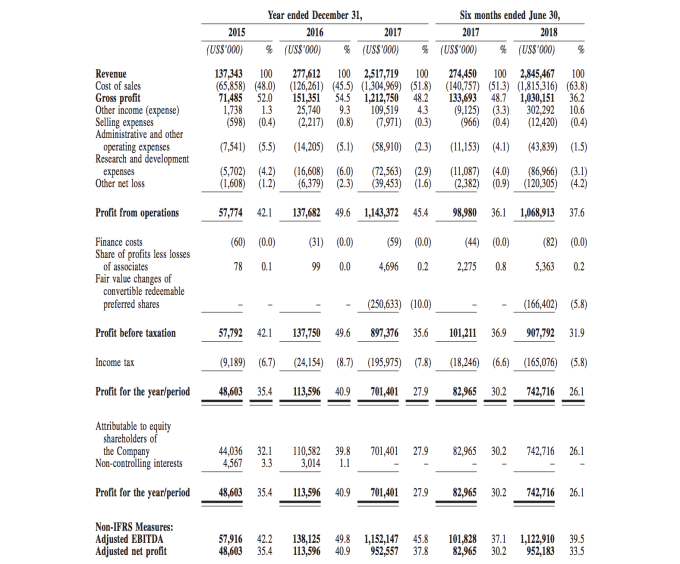

In 2017 Bitmain had $2,5 billion in revenues, almost ten times more than 2016’s $278 million. For 2018, Bitmain already touched $2,8 billion in revenues. Profits also soared from $104 million in 2016 to $743 million this year.

Anyone slightly interested in cryptocurrencies knows about Bitmain’s “Antminer” which is a specialized mining equipment for Bitcoin and other cryptos. Ninety-four percent of that revenue comes from Antminers, owned by more than 80,000 customers.

So far so good, however, 2018 brought new problems.

- Decreasing Margins

Since the beginning of 2018 cryptocurrencies’ prices are way lower than in the fourth quarter of 2017. The margins were around 54% back in 2016 and now they are 36%.

- Accepting Bitcoin

Bitmain accepts payments from miners in Bitcoin as well. Twenty-seven percent of the equipment was sold via Bitcoin. The company is exchanging crypto to fiat and uses in business. However, the dramatic decrease in crypto prices creates an accounting problem which results in a loss of $100 million.

- Overestimating the demand

Just like Nvidia, Bitmain also overestimated the sales figures for 2018. The company was misled by the growth of crypto by the end of 2017, but the high volatility and fall of the market resulted with an oversized inventory.

- Bitmain lost $500 M staking on BCH

In late 2017 - early 2018 the company traded most of its bitcoins for Bitcoin Cash when the coin rate was around $900. Over the past six months, savings of the mining monopoly in BCH has sunk, on average, by $500 million. If it wasn’t for the help of Bitcoin Core developers, who closed critical vulnerabilities of Bitcoin Cash fork, Bitmain could lose all of its savings in this cryptocurrency.

All these factors are an obvious drag but Bitmain has a strategy in place. The new 7nm-mining chip was announced last week which promises higher efficiency and power to miners. When profits of miners rise, Bitmain will earn more as well.

Besides mining equipment, Bitmain is dealing with AI chips to power cloud systems and visual recognition applications.

The company is investing $86 million into R&D, to fuel more than 700 research and development employees.

The announcement of Bitmain going to IPO didn’t come as a big surprise to the community. The rumors which were supposing the mining giant to raise $3billion in an IPO appeared in the middle of August.

Already back then it raised some concerns among the experts as they saw Bitmain IPO as very risky for investors. The confirmation and the papers that were unveiled yesterday raised a new wave of criticism. The discussion on Reddit which was created yesterday gained over 189 comments. Redditers put Bitmain IPO under the microscope and discussed every detail, even mentioning that “This is the beginning of every cyberpunk dystopia.”

Some even suspect the conspiracy theory behind the future of Bitmain IPO.

Bitmain’s IPO Application Proof is 438-pages and available to the public with redactions.