Halal or Haram?

There have been heated debates among Islamic scholars on whether cryptocurrency is ‘halal’ (permissible) or ‘haram’ (not permissible). While some predominantly Islamic countries have embraced cryptocurrency, others think that the digital money is against the Islamic law.

Earlier this year, California-based Stellar received certification from Islamic scholars for its blockchain platform and related cryptocurrency, as the company aimed to integrate the technology into the field of sharia-compliant financial products. The Shariyah Review Bureau (SRB), an Islamic advisory firm licensed by Bahrain’s central bank, provided the certification for Stellar, alongside guidelines for the types of assets that can be traded in its platform.

“For the blockchain technology there was no issue, the main thing we needed to consider was the use of the underlying cryptocurrency,” said Mansoor Ahmed, assistant general manager at Shariyah Review Bureau.

In May 2018 the Masjid Ramadan mosque in London started accepting donations in bitcoin and ethereum. The mosque declared that Muslims can use it for their Ramadan donation, known as zakat. Muslims are meant to give away 2.5 percent of their wealth to charity during Ramadan, an annual donation which is compulsory for all but the poorest Muslims.

Compliant projects:

UAE based ADAB Solutions has announced the launching of the First Islamic Crypto Exchange (FICE) - the only Shariah compliant crypto exchange in August 2018. “Now there are no companies offering comprehensive solutions for Islamic crypto investments. We intend to solve this problem,” ADAB Solutions said in a blog post as it announced the launch.

FICE is intended as a reliable crypto trading platform to serve 1.8 billion Muslims living on the planet. Although the first project to allows crypto transactions to be performed in accordance with the principles of Islamic finance, it will still be open to all users, regardless of their religion.

Committed to the high moral requirements set forth by the Shariah community, the company will utilize the in-house Shariah Advisory Board represented by international Shariah experts to ensure that FICE activity will comply with Shariah principles at all times.

Reuters reported last month that new digital exchange known as Huulk aims to attract listings from around 20 Sharia compliant financial technology startups, some of which operate in Muslim-majority countries like Turkey and Malaysia. The exchange - part of the OneGram Group of companies - also plans to list its own sharia-compliant cryptocurrency on the exchange by mid-September.

But what’s the attitude toward cryptocurrency in some of the predominantly Muslim countries?

Iran

Iran is one of the countries which is looking closely into cryptocurrency to ease the burden of U.S. sanctions. Just recently, Iran accepted cryptocurrency mining as an industry. The country’s Cyberspace Council is developing a platform for cryptocurrency mining regulation, IBENA quoted the Council’s Secretary Abolhassan Firoozabadi as saying. Firoozabadi added that the launching of a national cryptocurrency could be used as a financial transaction instrument with Iran's trade partners and friendly countries amid economic pressures through U.S. sanctions.

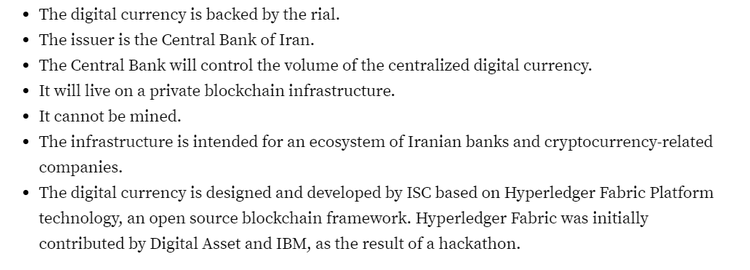

The development of the government-backed digital token is currently underway. Pegged to the rial, Iran’s new digital asset is based on the Hyperledger Fabric Platform and will be used to settle domestic and global SWIFT transactions.

IBENA, a news outlet and affiliate of the Central Bank of Iran, reports that the Informatics Services Corporations (ISC), also an affiliate of the Central Bank of Iran, has released the following information regarding the digital currency.

The Central Bank of Iran is set to introduce its official stance on cryptocurrencies later in September, 2018. At the moment, cryptocurrencies operations are banned by Iranian banks and credit institutions, due to money laundering concerns that were first raised in December, 2017.

Saudi Arabia

Last month Saudi Arabia banned trading of cryptocurrencies in the kingdom. A government committee comprising ministries and the Saudi Arabian Monetary Authority - the central bank - issued a warning against the "illusion and get-rich" schemes by high-risk traders. The committee said in a statement that bitcoin is outside of government’s control and therefore poses "negative consequences and high risks on traders.”

The announcement followed the launch of BitOasis, a leading digital asset wallet and exchange in the Middle Eastern and North Africa region. Citizens in Saudi Arabia, the UAE, Kuwait, Bahrain and Qatar can use the exchange service by sending money to a BitOasis bank account and exchanging it for bitcoins for a one percent fee.

The company still hopes to overcome the Saudi ban. The Dubai-based cryptocurrency exchange has said it is working with regulators across the Gulf Cooperation Council (GCC) to develop regulatory frameworks and “build confidence at the highest level.”

“Digital assets and blockchain technology are a reality and are here to stay. They are the future of money,” Ola Doudin, CEO of BitOasis told Arabian Business in a comment.

Turkey

With the Turkish lira under severe pressure also due to U.S. sanctions which prompted a period of deep economic turmoil, cryptocurrency trading in Turkey is surging, as many investors no longer trust fiat currencies. Even though mass cryptocurrency adoption still has a long way to go, Turkey has now emerged as the most likely country to mass adopt the digital currencies.

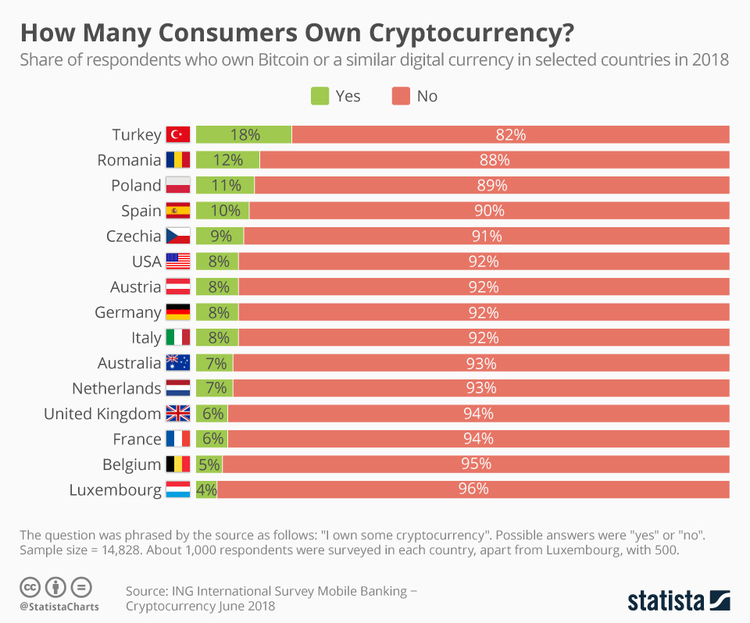

According to research conducted by Statistica, among 15,000 individuals, 18% of respondents in Turkey hold bitcoin or other cryptocurrencies.

With the exchange rate of the Turkish lira dropping further, Turkey's exchanges report an increase in the volume of crypto trading.

According to Forbes, Koinim, Turkey’s largest exchange, has reported a 63% increase in bitcoin trading volume, while the BTCTurk and Paribu exchanges have said their volumes are up 35% and 100% respectively. Banks in Turkey often work with local exchanges, meaning fresh adopters can begin buying and trading with greater ease.

In a most recent development Turkey's Borsa Istanbul Stock Exchange (BIST) has developed a blockchain-based system for healthy information flow between financial institutions according to the official website. The recent development will synchronize the customer databases of Borsa Istanbul, Istanbul Clearing, Settlement and Custody Bank (Takasbank), and the Central Securities Depository of Turkey (MKK).