The largest share buy out in the history has not come to pass. Founder and CEO of Tesla (NASDAQ: TSLA), Elon Musk has announced on the corporate blog that the company will remain public.

“Based on all the discussions that have taken place over the last couple of weeks and a thorough consideration of what is best for the company,” says a message from August 25. To turn back on his own idea, Musk needed 17 days. That’s how it happened.

Where it all began:

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

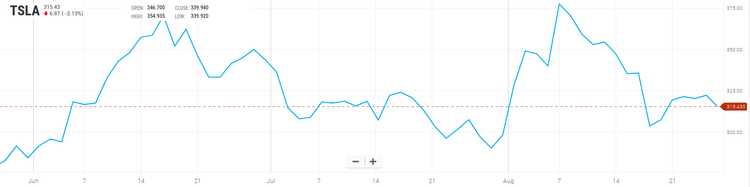

Musk initially announced his plan to take Tesla out of the stock market on August 7. The entrepreneur has proposed the investors to buy out their shares for $420 each, which is 20% higher than the price at the time. That news has shocked the market: that same day Tesla shares spiked by 11%m from $340 to $380, although it did drop back down just as fast. That fall came about from some of the controversial words said by Musk himself, that surfaced during those days.

Contradiction №1

What Musk said: In his first twitter post, Musk claimed that financing is secured. However, it turned out that was not exactly the case. According to Tesla’s founder, Saudi Arabia Sovereign Wealth Fund was ready to buy out the company that recently purchased a 5% stake in Tesla.

In reality: It turned out that at the time of writing no agreement on a deal was in place.

Contradiction №2

What Musk said: According to the entrepreneur, he also discussed the deal with an investment bank Goldman Sachs, banking consortium Morgan Stanley and with Silver Lake firm.

In reality: Sources told Financial Times that they have not heard anything about the entrepreneur seeking funds to buy out the company.

Contradiction №3

What Musk said: One of the first things Musk said that for a total removal of Tesla form the stock exchange, the only thing that’s left is a shareholder vote.

In reality: Six members of the board of directors of the company later said that Musk began discussing the idea only a few days prior to the announcement.

Lawsuit against Musk

Here’s another unfortunate moment: a group of Tesla shareholders that were playing on a decline, has filed a collective lawsuit against the company’s founder, claiming they have incurred considerable financial losses as the result of the tweet. According to the plaintiffs, the tweet contained false information that forced the price of shares upwards, which lead to the losses.

U.S. Securities and Exchange Commission (SEC) will investigate the case to find out if Musk was indeed trying to manipulate the share prices. Soon he will be called to testify.

Conclusion:

Regardless of what happened, Tesla is to remain a public company. Musk said that most shareholders have voted for the status of the company to remain unchanged, including the institutional investors. Some of them have underlined that they have limited resources when it comes to investing in private business ventures.

Moreover, the company will focus on the Model 3 and becoming profitable. By remaining a public company, Tesla will be required to continue publishing financial reports which thus far only serve to displease shareholders and analysts.