OneCoin (“One Coin Limited”, Gibraltar) is a multi level marketing platform, which has operated without a blockchain technology since January, 2015. OneCoin positions itself as a "digital currency, which is based on cryptography" and as an alternative to bitcoin. In reality OneCoin token has never existed, but this fact hasn’t prevent the company from conducting a fake ICO and attracting investors from ten countries. The pyramid worked on the network marketing system - investors were offered a reward for buying coins and attracting more users.

All these alarming signs didn’t prevent the company from working throughout Europe and Asia for more than six months and attracted millions of dollars before the governments of different countries began to worry about the legitimacy of this business. The first one rang in Bulgaria when the Financial Supervision Commission published a message that OneCoin isn’t recognized as a financial instrument and is highly risky.

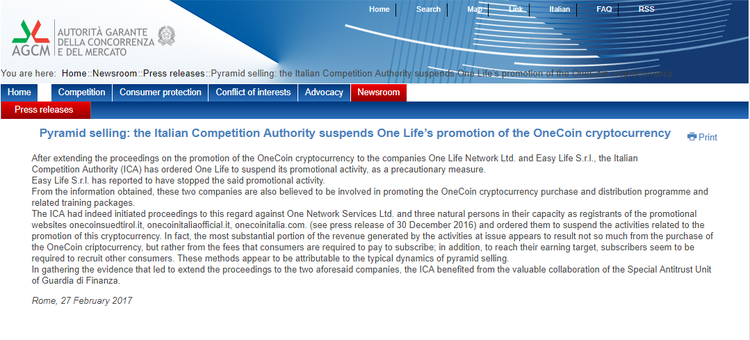

The same warning was published by UK, Italy, Belgium and Uganda authorities. First warnings were published in 2015 but the official authorities only reacted only in the beginning of 2017. In February, 2017 the Italian Antimonopoly Authority completed the investigation and banned all actions with OneCoin.

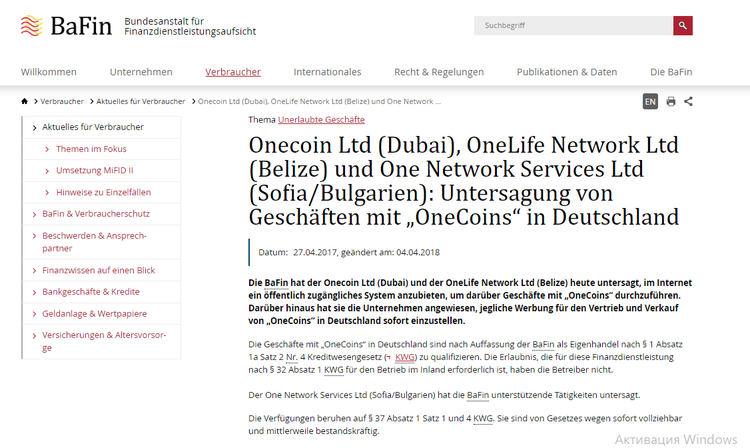

The same ban was published by the Federal Financial Supervisory Authority of Germany (BaFin) in April and by the International Financial Services Commission of Belize later in May.

But the real arrests began only in spring 2017, in India by Navi Mumbai Police and in July OneCoin was declared a Ponzi scheme.

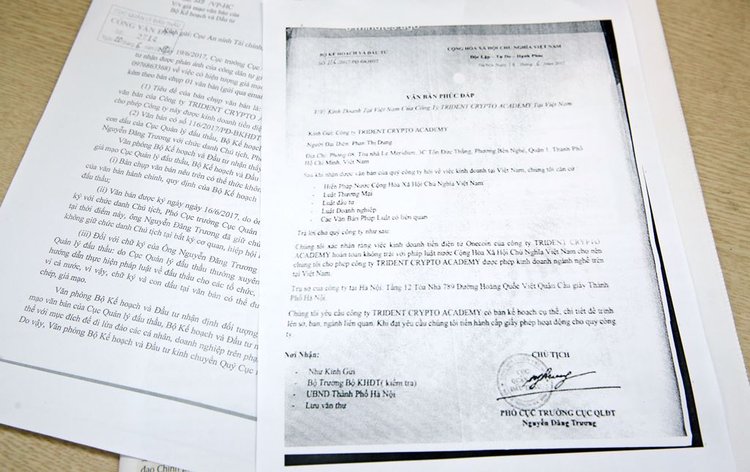

In VietNam OneCoin, made an extraordinary trick - the company delivered a statement that OneCoin is licensed by the Vietnamese Ministry of Planning and Investment and is legally allowed to be used in VietNam as a digital currency. In its turn, the Ministry published a statement about the falsification of the document.

The company's founders denied the charge - saying that the project received official permission from the Vietnamese government to operate with the cryptocurrency. Till the end of 2017, authorities of Thailand, China and other countries banned operations with OneCoin and warned citizens against the purchase of the token. It’s still unknown how much funds the company managed to gather - some says the amount may reach up to $11 billion worldwide. The founder of OneCoin - Ruja Ignatova - deserves a special attention. And believe us, her story can easily overshadow the epic fantasy novels of George R. Martin.

Ruja was born in Bulgaria, but in childhood she moved to Germany, becoming a German citizen. According to OneCoin official website Ruja graduated the University of Oxford (England) with a master's degree in jurisprudence, and also the University of Konstanz (Germany) with a master's degree in economics.

After graduation, Ignatova worked as a partner in McKinsey & Company. She also worked as a CEO of one of the biggest capital management funds in Bulgaria - CSIF, and later led a number of projects in the Texas Pacific Group (TPG). In Bulgaria Ruja became famous as one of the most notable business ladies and was twice awarded as the "Business Woman of the Year" in 2012 and 2014 and even was on the cover of Forbes Bulgaria, although it turned out that it was an advertisement campaign.

Watch the famous Forbes Bulgaria edition.

Nevertheless, Ruja actively promoted her project and was its face performing in various forums and events and was very active on social networks.

The fairytale couldn’t last forever and in autumn 2017, after searches, accusations and proceedings Ignatova disappeared after giving birth to a baby girl. She wasn’t seen neither by the employees nor by the distributors.

But from bad to worse: each day more and more details appear of her how she is conducting the business and her questionable connections. For example, with the cocaine king of Eastern Europe, the Bulgarian called Taki, according to the French StreetPress investigation.

According to the investigation, Ruja sold a luxury property in Bulgaria for $6 million to Taki’s wife. There is also the opinion that Taki participates in OneCoin business but there is no evidences according to German Gerlach Report. After Ruja’s disappearance, Onecoin was passed on to her colorful brother - Konstantin Ignatov, who according to some reports is a member of Bulgarian mafia group.

Since allegedly it was rather dangerous to conduct business in Europe, Konstantin turned to Latin American country of Argentina, where he promotes OneCoin and even announced the company's IPO in October 8, 2018. But, as it could be expected, quickly postponed the process to 2019.

It‘s open to anyone’s imagination how many clients Konstantin Ignatov can deceive in Latin America. But the most questionable thing is that the project, that doesn’t even support classical decentralized cryptocurrency or a ledger, which token isn’t traded in any public exchange, is still operating.