Part 12. The week of disillusionment.

This blog’s seventh entry is about an anticlimax - Don’t invest in ICO’s, way too late with it!

A couple of months ago I was still a relative outsider to the crypto-space and, from that position, it almost looked like a utopia. Of course, I’ve heard about hacks and scammy ICO projects, who hasn’t, but I always thought that those stories were just isolated cases.

I closed last week’s blog with a failed attempt of finding a decent ICO to contribute to. We’re way past the peak ICO hype, but it seems that we’re also way past the stage when we actually get to see legitimate projects. Or, perhaps, they’re just drowning in the sea of scams.

I stumbled upon this: back in February, 2018 bitcon.com have conducted a comprehensive analysis of the ICO market and concluded that 59% of the campaigns held in 2017 are either confirmed failures or failures-in-the-making. So, out of 902 ICOs, 142 failed at the funding stage, 276 have either faded into obscurity or ran away with the investors’ money and an additional 113 have stopped all social-media communications, hinting at an impending collapse.

Looking for a more up-to-date information, I found a couple more reports, all singing the same tune: 78% of all ICOs are scams, over 50% of ICO projects don’t survive past the fifth month of their existence and ‘if you bought into an ICO in 2018, you’ve probably lost half your investment’.

On top of that, I’ve spent a big chunk of last week browsing ICO projects and, quite honestly, laughing all the way. What I’m trying to say here is if you’re considering investing in an ICO in 2018 - DON’T. In the Summer of 2018, they’re by no means a way of making a quick buck. They’re a great source of entertainment though. Honestly, it seems like this team is behind most of the current ICOs:

Right now, at least to me it seems that the project has a lot more credibility if the startup purposefully avoids a crowd sale. I write press-releases and blog posts for one project which managed to attract an investor at a very early stage. Their product doesn’t really need its own token, so this was the perfect case scenario for them. The current situations is that the ICO market became so shady, some actually use that they didn’t need a crowd sale as a selling point for their project in numerous publications. And it works!

ICOs in particular and, to be fair, cryptocurrencies in general are in a bit of a dip, and I don’t mean it in terms of market valuation or prices. We’ve reached peak hype back in December/January, 8 years after the new, distributive technology was introduced, as more and more people realised that it’s a space to make money from. It was like a gold rush. Now, the space seems relatively quiet, doesn’t it? The mainstream media seems to have forgotten about crypto all together, it’s been a while since we’ve actually heard some success stories or had big projects launching successfully.

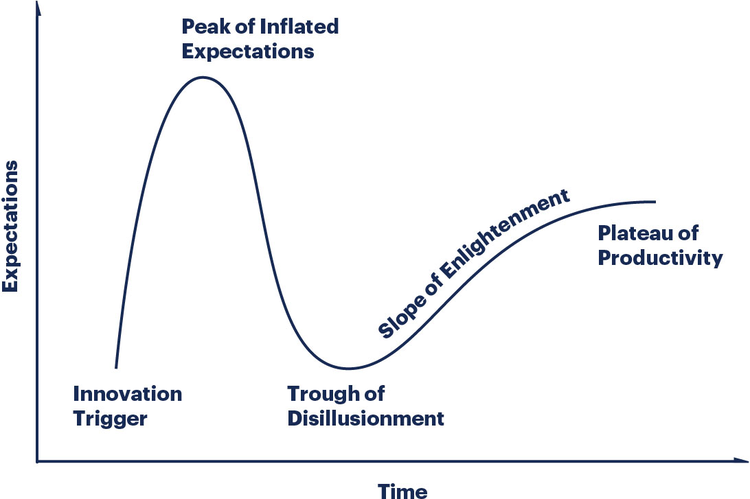

I’ve always thought that this kind of pattern is true to many things, albeit on slightly different time scales. Like, when any new and promising technology gets introduced it immediately gets hyped up - first by the tech media, then by the mainstream outlets. Then, the hype disappears and there are two scenarios - the technology survives the cycle and keeps on developing or it completely dies out like it happened with Google Glasses.

Do you remember this thing? Everyone thought it was the future, but I’m not going to lie - I’m really, really glad it isn’t. Apparently, this hype cycle is an actual thing. Just yesterday, I came across this:

By the way, do you not think this graph kind of looks like the Bitcoin price chart?

I think right now, the crypto space is in the Trough of Disillusionment. I myself am definitely there having slowly realised how many scammy, boring, unimaginative, unnecessary and just plain stupid projects there are. The good thing is - they’re going to die out at some point soon and we will head to the right direction. I hope.

Part 13. ICO are even shadier now.

The reason why I (once again) rambled on about ICOs is this:

That’s one of the way cryptocurrencies can grab headlines, I guess. It’s a cheap trick: just mention porn and you’re guaranteed to get attention (I do this all the time in those blogs).

Now, let's get this stuff straight, Tube8 isn’t launching an ICO, nor are they issuing their own token. Instead, they’re planning to integrate a Vice Industry Token. Apparently, one of VIT’s mottos is ‘Get paid to watch porn’ - which is nice and all, but it’s not that simple.

Just think about it - Tube8, as far as I remember, is a free website. They’re going to pay their users to ‘engage’ with their content, which means spending more time online, upvoting content, posting comments and so on. Basically, extending the viewing times as well as the number of clicks from every user so that the website itself can generate more revenue.

Don’t get me wrong - I’m not slating this approach, I think it creates a win-win situation as long as the VIT token will actually manage to get any value. What’s interesting about this is that users are basically mining VIT tokens by interacting with a porn-site for as much as they can. And, judging by the VIT website, they are not going to stop there:

It seems that sooner or later we’ll be able to ‘mine’ new tokens by doing pretty much anything. Opened you fridge? Here’s a token. Took a bus to work? Here’s a token, enjoy. Lost all your family’s saving playing blockchain poker? Here’s a couple of tokens, thanks for using our services.

This news story really reminded me of another emerging trend - trade-to-mine. I was asked to write a little article about it by one of my clients the other day, I did a tiny bit of preliminary research and right off the bat I can say that the whole idea seemed kind of shady.

For those of you who don’t know what it is: trade-to-mine is a new model of getting tokens pioneered by the Asian exchanges as a response to Binance and Huobi Pro introducing their own native tokens. While Binance rewards its customers for using the Binance Coin with discounts on trading fees, exchanges like FCoin, CoinBene and Bit-Z are taking it an extra mile. They charge traders fees in bitcoin and etherium, but immediately reimburse them, but in their native tokens.

So, essentially it seems that traders don’t have to pay fees at all, which I guess is a good thing. But how will the exchange actually make a profit? The answer here is very simple - profit is made solely through the valuation of their native token. Honestly, this seems very suspicious to me, especially considering the fact that some exchanges, namely CoinEx, have allocated 50% of all issued tokens to the exchange’s team. I’m sure most exchanges are doing the same thing or even worse.

Once again: traders pay fees in BTC or ETH, then they immediately get reimbursed in the exchange’s native token. Does this scheme remind you of anything? Like, say, literally every ICO that has ever happened? To me it seems that most people have realised that ICOs are practically a gamble, so to hold a ‘successful’ ICO these days you just have to disguise it somehow. In the case of trade-to-mine, ICOs are disguised as entire cryptocurrency exchanges.

Since native exchange tokens are mostly controlled by the exchange’s teams, they can easily manipulate the prices of tokens that they almost forcefully shoved in traders’ faces under the guise of reimbursing their fees, all the while hoarding BTC and ETH. This is what monopolisation and full centralisation within a particular exchange looks like. Of course, there is money to be made from it, but I’m not getting anywhere near trade-to-mine schemes, the whole thing just reeks of a fishy, scammy smell.

On top of that, I think that the Vice Industry Token’s integration with Tube8 is of the similar scent. By the sounds of it, this collaboration will be transforming a free website into a platform that will milk clicks and viewing times, with the sole intention of maximising profits through increased traffic and advert revenue. The incentive itself is a very questionable one - VIT is currently ranked the world’s 683rd cryptocurrency according to coinmarketcap.com. It’s worth a mere $0.008, and despite being all over the news thanks to the Tube8 integration it’s down by 2% over the last 24 hours.

Both cases described above are just ICOs with extra steps, which makes them even shadier than ICOs have ever been. Then again, I could be wrong, but I honestly don’t think I am.

—

To be honest, this wasn’t supposed to be a serious opinion-piece it turned out to be, I was actually going to entertain you all with more ridiculous ICOs. But then I stumbled upon that hype cycle graph and realised that we are scraping the bottom of the Trough of Disillusionment right now.

This past few days I’ve looked through countless ICOs for your amusement, made some decent trades, a couple of horrible ones, but getting all those thoughts out seemed a bit more important for me.

Next week this blog will be all fun and games, I can promise you that much. See ya!