Stablecoin is any cryptocurrency pegged to a stable assets such as gold or fiat currency. A stablecoin is posed to have low volatility as opposed to other cryptocurrencies. While regular cryptocurrencies are subject to major shifts in price following every tiny shift in demand, stablecoins are relatively constant, and this makes them better both as a store of value and as a method of payment.

Stablecoins are divided into three categories: fiat-collateralized, crypto-collateralized, and non-collateralized (seniorage shares).

Each unit of a fiat-collateralized stablecoin is backed by a fiat currency, such as the U.S. dollar. In order to spend a stablecoin, the third party delivers the fiat coin to the owner and burns the stablecoin. While these stablecoins ensure a higher degree of price stability, they are often criticized for relying on a centralized party, such as a bank. Besides, they need to have audits to make sure right amount of collateral is being held by the issuing firm.

Crypto-collateralized stablecoins rely on the value of the cryptocurrency they use as collateral to maintain a constant price relative to some other asset. They ensure much better liquidity, are more decentralized and transparent, but are not as stable as fiat-collateral stablecoins. In this case a ratio of more than 1:1 is held to back the stablecoin, meaning that a deposit of $400 of bitcoin will be needed to receive $200 in stablecoins.

Non-collateralized stablecoins rely on a combination of algorithms and smart-contracts, using supply-demand principles to maintain price equilibrium.

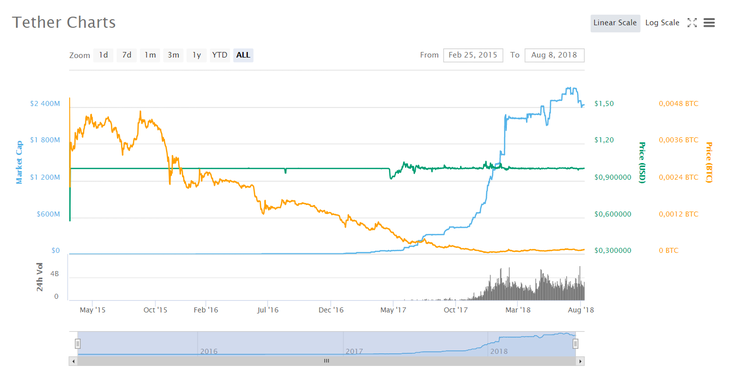

Tether (USD₮) is the largest stablecoin with market capitalization. With a market cap of over $234 billion and a daily trading volume of $3.3 billion, its ranked 9 at Coinmarketcap.com. Every Tether is allegedly always backed 1-to-1 by traditional currency. Therefore, 1 USDT is always equivalent to $1. Tether also supports Euros (EUR) and is expected to add support for Japanese Yen (JPY) in the near future.

There are currently over 2 billion USDT coins in circulation, and Tether company claims to have fiat currency reserves to backup all of them, but no concrete evidence to back this exists.

The cryptocurrency was created in 2015, originally called Realcoin. According to Tether’s website, the cryptocurrency enables businesses – including exchanges, wallets, payment processors, financial services and ATMs – to easily use fiat currencies on blockchains. The following businesses in the cryptocurrency ecosystem have integrated Tether:

While the cryptocurrency community is worried that Tether Limited doesn't hold enough currency reserves to back all the tethers in circulation, the company has strongly denied all the accusations. A report released last month by law firm Freeh, Sporkin & Sullivan LLP (FSS) claims that all Tethers in circulation are fully backed by USD reserves.

“Reserves have always, and will always, match the number of Tethers in circulation,” the report reads.

TrueUSD is another stablecoin backed by the U.S. dollar. According to the project's official website, “every TrueUSD is always 100% collateralized by USD, held in professional trust firms’ banks.”

Ranked 107 by price tracker CoinMarketCap.com, the cryptocurrency has a total market capitalization of close to $60 million and a daily trading volume of over $18 million.

TrueUSD has been created for a few use cases including simple financial services, trading, and online commerce. There are currently over 58 million coins in circulation, and there will only ever be as many tokens in circulation as there are dollars in the third-party escrow account to collateralize the tokens. TrueUSD is currently listed on Binance, Bittrex, Upbit, and a number of other exchanges.

The platform is planning to add the TrueEuro, TrueYen, and stable baskets of tokenized goods (including precious metals and real estate) in the future.

In June the Malta-bases platform Stasis launched EURS, a new stablecoin built on Ethereum’s blockchain and backed 1-for-1 by the Euro. With over 12 million tokens in circulation, EURS is currently listed on two exchanges - HitBTC and DSX. It claims to be the tokenized version of the Euro that “captures the benefits of blockchain technology and traditional finance.”

Stasis assures EURS is convenient for cross-border transactions, as it combines the stability and reliability of traditional currencies with blockchain advantages.” Furthermore, it says the Euro and other national currencies are not the only type of asset that STASIS can tokenize on the blockchain. Securities and other assets can also be converted, provided there is demand.

MakerDao (DAI) is an Ethereum ERC20 token that is pegged to $1. Dai is worth $1, and will always be worth $1, regardless of how much dai is in existence. Dai’s value is kept stable in relation to the U.S. dollar using a system of collateral and price feeds, but is not backed by actual USD holdings. Instead, the DAI is created on demand and backed by collateralized ether.

Anyone with an ethereum wallet can own, accept, and transfer it. Dai can be spent or traded freely like any other ERC20 token and its currently listed 114th on CoinMarketCap.com, having a total market capitalization of over $55 million.

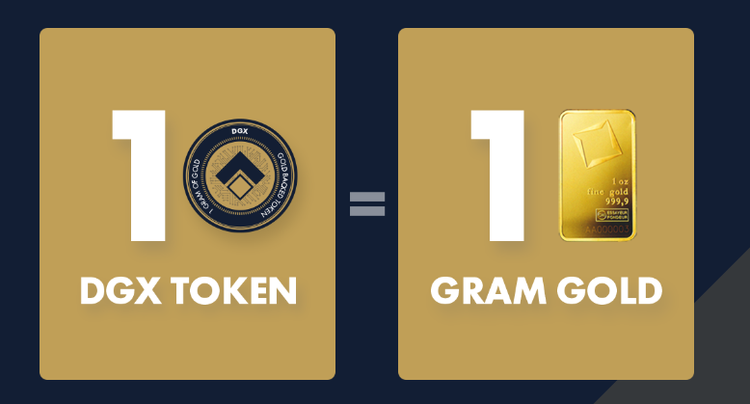

Digix Gold (DGX) tokenizes gold on ethereum. Using blockchain technology, it represents physical gold with DGX tokens, where 1 DGX is equal to 1 gram of gold on ethereum.

DGX tokens can be easily transferred across exchanges or platforms on ethereum. The tokens can also be easily stored in and transferred between ethereum compatible wallets.

According to Digix Gold’s official website, the DGX is a digital token backed by 99.99% gold cast bars from London Bullion Market Association-approved refiners. They claim to be carrying only gold of the highest quality, using 100-gram swiss gold bars from world-class refineries such as Valcambi, Produits Artistiques Metaux Precieux (PAMP), Metalor.

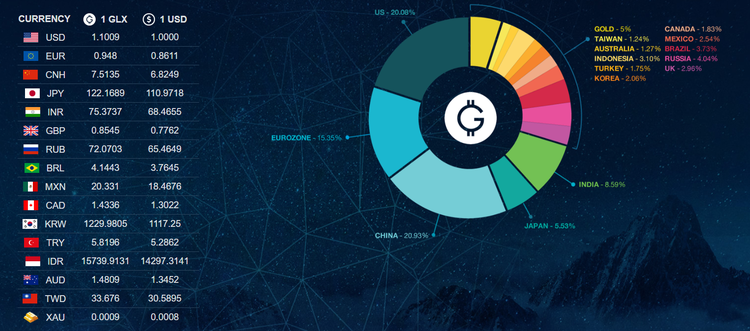

Globcoin (GLX) is a cryptocurrency backed by 15 different global currencies and gold. GLX is a stable crypto asset that functions as a store of value and a medium of exchange.

Basis is an example of a non-collateralized stablecoin. It is a cryptocurrency aimed at keeping the price of a basis coin at $1. Basis is designed to keep prices stable by algorithmically adjusting supply. When demand is rising, the blockchain will create more basis. The expanded supply is designed to bring the price back down. But, on the contrary, when demand is falling, the blockchain will buy back basis to restore the price.

SwissRealCoin is a stablecoin, whose value is linked to a portfolio of Swiss commercial real estate. It serves as a link between real estate, cryptocurrencies and technology (blockchain, AI, big data) to automate real estate asset management on the blockchain.

X8C is a 100% asset-backed token. The token has an intrinsic value in holdings in gold and 8 fiat currencies, which include USD, EUR, JPY, AUD, GBP, CAD, CHF, NZD. The team behind X8C says the tokens can be used for long-term store of value and are ideal for raising funding capital in IPOs/ICOs, as CEOs can easily plan the distribution of collected investment and costs due to X8C value stability.

Developers claim X8C can serve for fixing salary value between employer and employee, as value paid and received will remain almost in line with inflation.

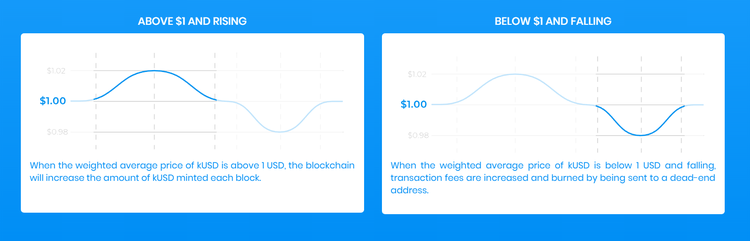

Kowala’s kUSD is designed to target a stable value equal to $1. The tokens are minted automatically by the blockchain to satisfy market demand. The number of kUSD can grow into the millions, billions, and beyond to satisfy market demand for kUSD. All newly minted kUSD are distributed to miners.

When the weighted average price of kUSD is above $1, the blockchain will increase the amount of kUSD minted each block. On the other hand, when the average price of kUSD is below $1 and falling, transaction fees are increased and burned by being sent to a dead-end address.