This blog isn’t just a diary for me - rather an exercise in self-control. It’s a commitment, and at times commitments are the only thing that push me to do more. Occasional depressions and anxieties are extremely complicated conditions to deal with, but over the years I realized that there’s only one thing that actually helps, or at least distracts from the constant wallowing: setting goals and achieving them. They don’t have to be life-goals like ‘I’m gonna become a millionaire by the time I’m 30’, I always start with the simplest ones, especially when I’m feeling at my lowest.

I had too many goals to achieve this last month, a lot of work and writing, I tried cycling as much as I possibly can, fix a few relationships and move to another flat. At some point, I burned out. For a brief moment I was back where I started - there were a couple of days when I did nothing productive at all. But commitments and a force of habit are wonderful things.

I watch a lot of YouTube videos when I’m in slumps like these. The kind of guilty-pleasure entertainment you don’t tell your friends about: hours of Jimmy Fallon, top-10 lists and pranksters that are physically painful to watch. Clicking aimlessly, I found a channel called Yes Theory - feel-good content about getting out of your comfort zone.

I watched their videos for a couple of hours until the mysterious YouTube autoplay algorithm took me to this one called ‘Surviving only using bitcoin for 24 hours’.

Nothing overly interesting, but - they booked flights, a hotel room and they tried to find food places that accept BTC. But the concept I was after, to get out of your comfort zone and my commitment to trading, activated me.

I realized that I wanted to avoid cryptocurrency exchanges at all costs, so that's exactly what I should get into. So, I took to YouTube once again to watch a guy who looks like a 50/50 mix between Pablo Escobar and Weird Al Yankovic explaining how Binance, a crypto-exchange of my choice, works.

I mentioned Binance last week when I wanted to compare trading volumes on DEX and a bigger, but centralized exchange. Binance was the first one that came to my mind, and I actually figured out why. Selective memory is a weird thing, I saw this picture a couple of weeks ago in one of the Telegram channels and I guess it got stuck in my head.

Part 7. Waving goodbye to Waves.

When I was a kid, my mother always used to tell me that she doesn’t get along with digits and I think I inherited that from her. I can understand the mechanics behind pretty much anything as long as there are no complex numbers involved. I’ve spent a couple of weeks trying to understand how exchanges work and I think I sort of, kind of get it now. But this still terrifies me:

One thing that took me a long while to figure out was the fact that behind every line of numbers there’s an actual deal between two real people. Once I started seeing those as ‘oh, so someone just sold 10 USDT for bitcoins at a price of 8155.15 USDT for 1 BTC and got 0.001227 bitcoins. AND someone else accepted those terms and traded with them’. I really want to be able to look at all those numbers and immediately get the whole picture in my head. But, I guess getting used to it just takes even more time.

I decided to ditch Waves altogether and move everything I had to Binance. Honestly, I got tired of Waves and DEX, but even abandoning the platform was kind of a challenge.

I had 30 WAVES in my account and I moved them all to Binance. Surprisingly, that took just 20 minutes. But of course, I forgot that I needed WAVES to pay a fee for transferring bitcoins out of their wallet. And this was easy to forget just because of how ridiculous that is. I had 22 cents left in my USD account, so I used that to get some more WAVES. The bitcoin transaction took one hour and thirty-five minutes as well as 0.001 WAVES and 0.001 BTC as fees. Not cool!

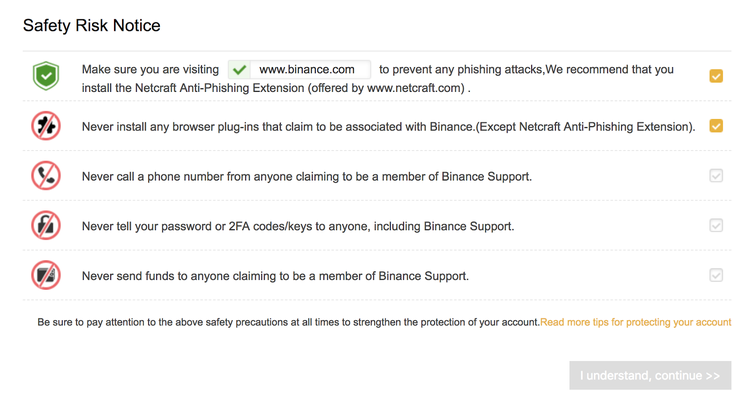

After DEX, Binance is like a completely new world which is completely different - a lot more serious and intimidating. Before creating an account, the try to make sure that you understand the risks involved:

For some reason, I always thought that creating an account with an exchange takes ages and requires some form of verification, but in reality, it took a couple of minutes. E-mail address, password and a phone number for an optional two-factor identification was all I needed. Once I registered, I had a look around. In the ‘Balances’ section, I counted 159 trade-able coins.

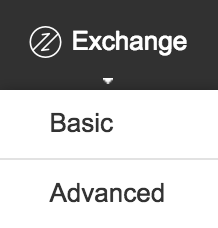

I took a deep breath, pressed on the ‘Exchange’ button and saw this. I looked at both versions and they honestly seemed almost identical. The basic version has a slightly different layout and you need to scroll down a page to see your current orders, while the advanced version is all on one page. Other than that they looked the same, at least to me. I think I’m going to stick with the Basic version for now, as there’s no way I can qualify as an ‘advanced’ trader. No way.

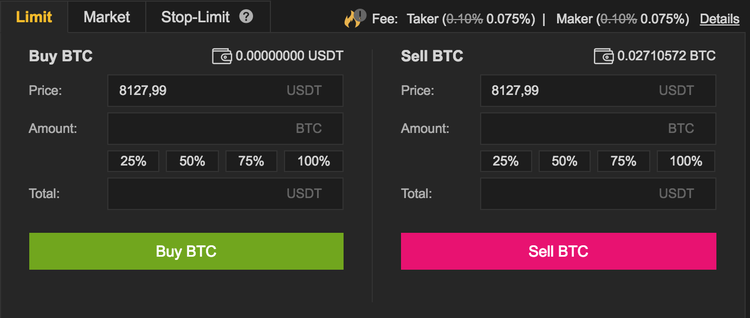

Obviously, there was a lot more going on than on DEX. I looked around, and the main differences kinda grouped around the order box. First of all, there are three different trading options. The limit is when you set a certain price you’d be willing to trade at. Limit trading was all I did on DEX - it’s a guessing game and you need to be very patient, but in my case, it usually paid off. Market means that you’d be trading at the current market price - great for quick trades, I think it’s kind of like ShapeShift within an exchange.

But Stop-Limit is a completely new thing to me. The Binance FAQ section says that a stop-limit order is executed at a specified price after a given stop price has been reached. Once the stop price is reached, it actually becomes a limit order. I know that traders use stop-limit orders as a safety net in case asset they’re trading lose in price, but so far I actually struggle to understand how it's different to a normal limit order. (a good topic to discuss in comments btw) I’ve read up on it on Investopedia and it didn’t help.

Another very important thing on that screenshot are the fees. Honestly, I took a stab in the dark and chose Binance on random, but its trading fees structure looks great. I’ve read that some exchanges can charge more than 0.2% for a trade, Binance charges half of that. Even less if you hold BNB - the exchange’s native token.

It’s worth noting that in the explainer video I’ve mentioned before Weird Al Escobar said that BNB fees are 0.05%. The video was uploaded several months ago, and since then Binance upped that price which is a little bit annoying, but still, it’s cheaper that most other places.

So I went and bought 1 BNB. I wanted to use Market trading, but got confused, typed in 1 BNB and pressed Enter for some reason (I don’t know why, don’t ask). The order went live and was completed within a second. So I went to the settings menu and pressed the magic button.

I’ve also found about their discount structure - it halves every year. So yeah, it was 50% last year, in 4 years time there’s going to be no discount at all.

I think I spent a day just browsing Binance and making sense of it all. Several YouTube tutorials later, I had some of the trading basics down (or so I thought). At this point, I wanted to find a coin that I could maybe flip for profit within an hour or so. Several YouTube ‘tutors’ described a perfect scenario: I’d need mixed markets, not all red and not all green, then I’d need to find a coin with good volume and no big news or announcements surrounding it at the time. This should allow for a rather ‘natural’ predictable fluctuation.

So, markets - check. The right coin - I went for Ripple which was 0.5% up, had great volume and seemingly no news or announcements on a horizon - check. This was when I bought it:

I got 100 XPR at 0.00005511 BTC, this was slightly lower than the market value, so I was happy. I was expecting it to bounce back pretty soon and placed a selling order at 0.00005518 BTC, but as you can see on the graph - it went lower instead. Half an hour after I placed that order I was asked to leave the cafe I was occupying for about 6 hours by that point. I really hoped that the order will come through while I was searching for Wi-Fi, but it wasn’t meant to be.

As I’m writing this I’m looking at its price going lower and lower, approaching its lowest point in the last several days. I’m looking at people buying it at a low price and I’m thinking they will make some profit out of it and I might not. I’m not going to sell it at a loss though, I’m going to leave that order open and blindly hope it’ll get filled at some point. Ripple is a strong token, I mean it’s third behind bitcoin and ethereum in terms of market capitalization. 100 XPR is about $50, probably one-third of my crypto-assets to date and I’m not going to give up on it.

—

I talked a lot about commitments in this edition of the blog. So I’m going to commit to this: next week’s edition will be a bit different. I’ll trade bitcoins against a new altcoin every day for five days. I’m not going to just trade though, I’m going to research projects behind the tokens I’m trying to profit on. So, next week, along with my pitiful attempts at cryptocurrency trading you will get reviews of 5 altcoins. Stay tuned.