Part 5. Drifting on Waves.

Last week as I turned in the latest edition of this blog on Tuesday, I managed to get a vague understanding of how trading works as I placed several easy-to-fill orders buying and selling Bitcoins for Waves and Ethereum. After I did it I realized how little sense those trades actually meant for me.

First and foremost, trading between two major established cryptocurrencies probably isn’t going to bring me any profits, especially considering the rather insignificant sizes of orders I’ve been placing. The day after my previous blog entry was posted, Bitcoin shot up and gained nearly 10% within 24 hours, causing other crypto-assets to do more or less the same.

Yet, in the same period of time Ethereum’s price went up 5.4%. Judging solely by those numbers, there is some potential profit to be made here. But all I can do at this very moment is place a couple of orders for a combined amount of $100. Even if I somehow managed to buy very low and sell super high, the biggest part of my profit would’ve probably gone on covering the transaction fees. I’m not saying it’s not doable, I simply don’t have what it takes just yet.

So, in an effort to try an mitigate this situation I decided to get active and trade on DEX daily, mostly buying and selling Bitcoins for USD. I put some finishing touches on the previous blog and decided to place an order: half of my Bitcoins (that was worth $44 at the time) with a set minimum price of $7,350.

When I did that, Bitcoin was trading for just a little over $6,800 (the crosspoint on the graph below), so I kind of thought this order might turn out to be one for the long-run. Several hours later I got a notification from one of the crypto-news websites saying ‘Bitcoin just hit $7,500’ and my heart rate went well up, I started sweating profusely.

I opened Waves, my order obviously came through, there were $50.5 in my USD wallet and that was the first time I’ve ever made money that way, it felt kind of dirty and I’m not going to lie, I LIKED IT.

At this point I was like ‘that’s it, I know what I’m doing now’, so I went ahead and made two more orders. I thought I’ll be extra clever this time and set up what I now realize are extremely stupid prices. Just look at that:

Opening my order book the next day felt like waking up after a night out and going through all the drunk texts I’ve sent. Shame, regret and the burning ‘what was I thinking’ question.

I guess I was hoping that it will make a slight dip to around $6,500 overnight and then go up just a little bit over 10k the following morning. That didn’t happen, so I had to reassert my strategy. And yep, obviously, I canceled both orders.

I decided to take the next day more hands-off on trading. My new plan was to open DEX every morning, take a look at the graph, place buying orders for a couple of hundred dollars under the price at the time, while placing selling orders a couple of hundred dollars over and hope for the best.

That plan actually kind of worked! Still, I was trading in very small orders, usually buying and selling no more than $50 worth. The biggest profit I made was from buying 0.0068 Bitcoins at $7,400 and selling them at $7,650, which brought me about $1.50. The other trades were slightly lower, which was mostly due to me panicking or losing patience - I always wanted the order to be filled in as quickly as possible, so I often ended up canceling promising orders and creating more ‘realistic’ ones. I think patience is key with this sort of thing, but so far it’s been the most challenging aspect of it all for me.

Over several days of rather passive daytime trading on a not-so-busy exchange, I’ve actually managed to turn the $90 worth of Bitcoins I had into around $104. Admittedly, probably half of that impressive $14 profit came from the massive jump Bitcoin made on Tuesday and Wednesday, but the rest was all me treading as carefully and sheepishly as I could in a relatively stable market.

Still, as great as making $14 in one week felt, I kept thinking about DEX’s limitations. I’ve spent over a week using it trying to understand why some of the orders took so long to go through until I’ve noticed that the exchange’s volume of the BTC/USD trading pair is just 0.365 BTC. In stocks, as well as in cryptocurrency trading, volume means the number of funds that exchanges handle within 24 hours, so it seems there’s not really that much action going on at this particular exchange.

In comparison, I had a look at Binance as it was the first crypto-exchange that I could think of (and I think it’s one of the biggest) and as I suspected you can’t really trade Bitcoins for Dollars there. They do have BTC/USDT pair though with the volume of 42,718 Bitcoins in the last 24 hours.

Now, USDT is Tether - it’s a stablecoin pegged to the value of a US Dollar. Stablecoins are supposed to be doing exactly what it says on the box: they’re cryptocurrency tokens with a stable value. Tether is the most famous one currently in existence, but as far as I know, it’s a rather controversial token.

The way it should work is: the company behind Tether has exactly $1 in its repository for every token that’s currently in circulation. According to CoinMarketCap, there are currently exactly 2,607,140,346 USDT out there, with a total planned supply standing at just a little bit over 3 trillion. Apparently, Tether Limited has been promising to issue an audit of their current reserves, but it hasn’t followed through on it yet.

The reason why I’m talking about Tether and stablecoins, in general, is that I’m actually considering signing up on an actual crypto-exchange. I don’t think I’m ready to trade just within the realm of cryptocurrencies though, I’m having some kind of a mental block every time I’m trying to understand the price ratios when there’s no fiat involved. At the same time, I do think DEX is limited and I might be ready to try venturing out into the bigger game where having a stable token as a safety net would be a great bonus.

Stablecoins were actually one of the reasons why I chose Jaxx over Exodus in the first part of this blog. Neither of them actually carry Tether wallets (which is not adding any points to its credibility), but Jaxx seemed to have more options. I might talk a bit more about stablecoins in the future blogs, I actually think they’re one of the most interesting parts of the cryptocurrency space.

—

I went a little bit off track, so let’s just quickly return to Waves.

I’ve used it for a bit more than a week, and I decided I’m not going to use it as my primary gateway to the crypto ecosystem anymore. I have a limited experience with wallets and crypto-transactions, but so far every single one of my transfers took no more than 10 minutes to appear in the receiving wallet. Then, the other day I tried sending some BTC out of my Waves wallet and it took almost two hours to go through, which wasn’t even the worst part.

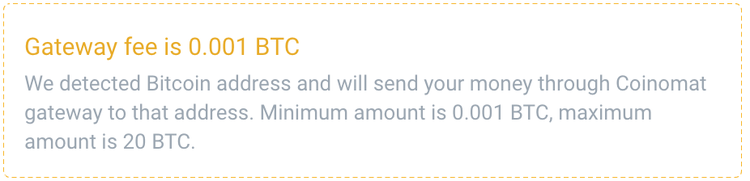

The worst thing is that this was meant to be a super-exciting transaction - a friend of mine who I was preaching Bitcoin to at the bar decided to try it out and set up a wallet. As a test, I tried sending him $40 worth of Bitcoin. As soon as I copied in his wallet address and the amount, I was greeted with this:

That is a fee of over $7 for a transaction of $40 worth of Bitcoins. Just a little reminder: my transaction fee for sending BTC into this wallet was just 0.000015 BTC, and now if I want to send my money somewhere else I’ll have to pay 66 times that amount. No joke, SIXTY-SIX TIMES MORE. ‘Yeah it’s free entry but you’ll have to pay to get out’. And, there’s an obligatory 0.001 WAVES fee on top of that too, as if the fee wasn’t big enough.

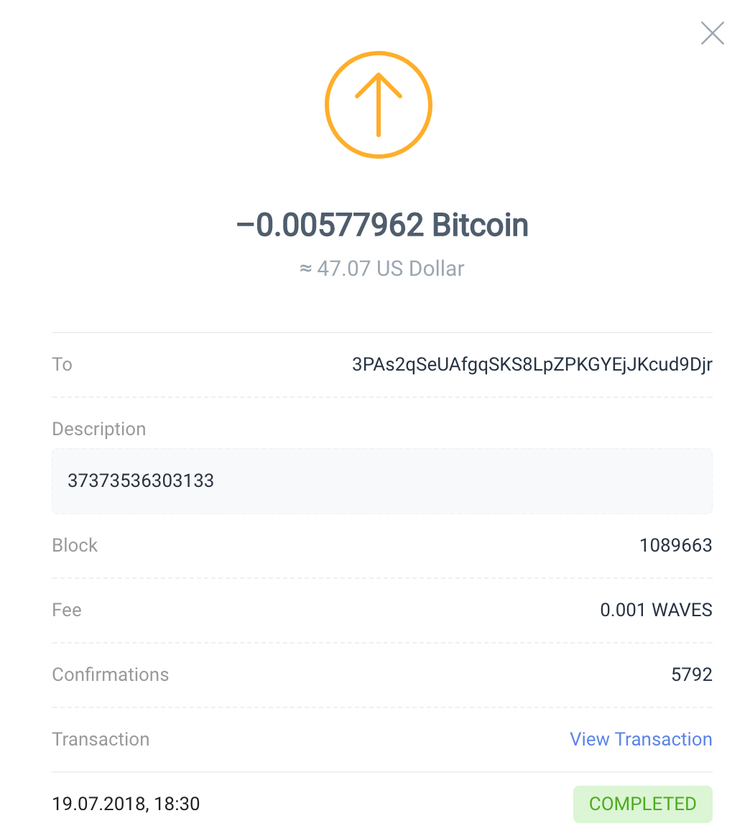

Still, I went for it, as this was the only way out. Here’s the transaction info for those $47 dollars, and that's ain't the worst part.

The bombshell came when I realized that the recipient’s wallet’s number stated is wrong, I copied and pasted a completely different number. That, and the fact that the money weren’t in my friend's wallet two hours after I pressed ‘sent’ made me flip.

The transaction went through, and I figured that it was so expensive and took so long because it probably hopped through a couple different wallets associated with Waves before it got to my friend, but no.

On top of that, two days before that transaction I was actually enjoying Waves so much I went and bought 30 of their tokens at a price of 0.000414 BTC. It’s the highest it’s been trading for since then. I figured OK, it doesn’t seem like I’m going to be able to trade them back for that price any time soon, I’ll just see what else I could do with them.

So, I found out I could lease my WAVES to one of the mining pools and make some money while essentially holding on to at least some tokens that could potentially go up in value at some point in the future. I’ve used a calculator on their website which didn’t really encourage me - it turned out I’d get no more than 0,1 WAVES a month for leasing 30. I did it anyway, we’ll see what happens.

—

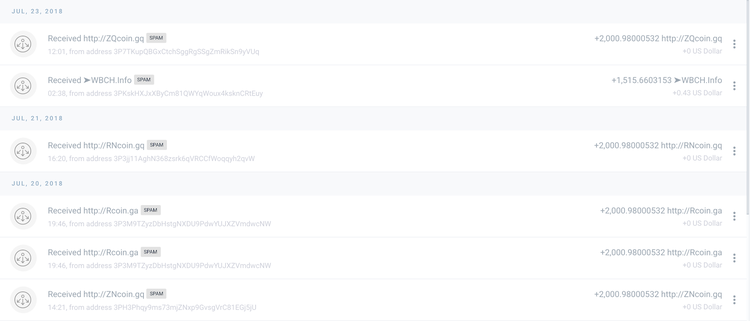

So now I was kind of stuck with all my Bitcoins on a platform that wants half of my weekly profit just to take them out, and with additional 30 WAVES tokens that I don’t really want anymore. The last straw was when I logged into my account to check the transaction history and saw this:

A daily dose of spam transactions. I have no idea what they are, where they came from and to be honest I have no intention of finding that out.

—

So, this was a very interesting, slightly turbulent week. I made my first profits and sort of learned how to trade, only to find out I’ll lose most of that profit as soon as I’ll try to get my money to a different wallet. Needless to say, that was not a pleasing experience. Still, I feel like spending a bit more time on DEX might be useful, at least to try and make up for that 0.001 BTC fee.

I’m leaving my options open for now, I guess I’ll figure out what my plan for next week will be depending on how it unfolds. Stay tuned, people!