True story of missing out.

So far, I’ve missed out on Bitcoin for under a dollar, Ethereum for $7, and the rest of 1620 cryptocurrencies listed on coinmarketcap.com at the time of writing, ICOs that brought investors insane returns, sometimes over 1000% of their initial investments, signals, pumps, HODLing, airdrops, hardforks, scandals, scams and so, so many other things.

Thing is, back in my early teenage years I used to spend a lot of time in front of my computer. And when I say a lot I mean I used to wake up, go to school, run back home and that was it, I would literally spend the rest of the day browsing image boards, exploring what the Internet has to offer. Ok, you got me, it was mostly porn.

But then this lifestyle kind of stopped, I became a bit more sociable, got tired of the negativity that was prevailing in that part of the online community and slowly but surely drifted away from it all by 2012. During that year, Bitcoin doubled in value and basically began it’s ongoing rally.

At that point, all I did on the Internet was scrolling through social networks, looking at memes and playing occasional first person shooters. Image boards weren’t my domain anymore, but if they were, I would’ve found out about Bitcoin early sooner and had plenty of free time to read, understand how it works and maybe, just maybe I would’ve asked my parents for money to invest in it.

But that didn’t happen, and my artificial detachment from that section of Internet went on for so long that I began noticing myself denouncing cryptocurrencies - it was all too complicated for me to even try to understand, and seemingly it was too late to buy in.

Then, just over a year ago, I was asked if I could write a how-to guide on Bitcoin. I knew nothing about it, but I agreed, thinking it was a perfect opportunity to research the subject while earning some cash. And, I really got into it all, the rebellious nature of the crypto-community spoke to me, and I understood why people are actually obsessed over it: blockchain is the f**king future.

Since then, I wrote several dozen guides on different cryptocurrencies and managed to build up a solid theoretical understanding of how things work. For some reason I kept telling myself that as soon as the next paycheck comes in, I’m gonna invest half of it, or at least a quarter, and actually start trading on the market. This was accompanied by my mental health problems, the combination of which made me at times reluctant to get out of bed, let alone learn something new.

Now I feel like I’m getting over it, and I made up my mind: I had to try investing. To keep me going, I will be writing a series of ‘what I did this week’ kind of articles. They won’t just be my diaries, I intend to research various aspects of the cryptocurrency space and present my findings.

This is my attempt at humanisation of cryptocurrencies for people like me - those who missed out and might be hesitant or too scared to get into them at this stage.

Part 1. The Basics.

A little disclaimer before I start: I might mention a lot of services, websites and apps in this article. None of those mentions is an endorsement, I’m not advertising anyone since I wasn’t paid to use them.

Over the past year, I’ve realised that all the graphs, predictions, all the market analysis, expert opinions, just don’t make much sense. Yes, most of the people voicing those views have a much greater knowledge than I do, but still, they’re largely just guessing.

I don’t know much about the stock market, but I know of Warren Buffet, who is kind of a stock market Jesus. He’s been saying that he will never invest in Bitcoin, it doesn’t produce anything and basically isn’t an investment at all. Still, there are people like Winklevoss twins (those guys who were played by Armie Hammer in the Social Network), who have last year became bitcoin billionaires. My man Warren, how on god’s green earth is that not an investment?

The only viable advice is the classic ‘buy low - sell high’. This winter, Bitcoin has hit it’s all time high at nearly $20,000, and it seems that a lot of people started buying it as soon as it went up. On February 6th, there was a quick dip below the $7000 mark, which to me seemed like a perfect opportunity, but as always, I missed out. I waited for the BTC’s value to sort of stabilise and got in at $6450. This was actually the lowest price Bitcoin got to all week - not a bad start.

Why did I start with Bitcoin? Yes, the network is slow, it gets congested at times, the mining fees can get too expensive, it can’t be used as a reliable payment method, but I actually still believe in it. Here are two reasons why: Lightning Network and Bitcoin exchange-traded funds (ETFs).

Scalability is perhaps the main issue that sets the Bitcoin network apart. It’s only capable of processing 7 transactions per second, and that is the network’s absolute maximum. Just to compare, VISA processes around 20,000 transactions every second.

But, the Lightning Network will supposedly fix that. It’s a whole new extra layer to the existing Bitcoin network, and it should enable users to set up bi-directional payment channels and perform limitless transactions within them. Only the opening and closing balances of channels will actually be recorder on the blockchain, so, in theory, the bitcoin’s network should easily handle thousands of transactions per second. The Lightning Network is still being developed and tested, there’s no set date of its public release.

What’s even more exciting is the impending arrival of Bitcoin ETFs. Without getting into technicalities, ETFs trading will open the legal way for institutional money to flow into cryptocurrencies. First European ETFs are not far away, and the U.S. financial regulator SEC is currently reviewing an ETF application from CBOE Global Markets. If approved, first Bitcoin ETFs should begin trading in the beginning of 2019.

Why is this exciting? It is estimated that once Bitcoin ETFs are introduced, the token’s price will be somewhere between $26,000 and $44,000.

I guess what I’m saying here is that before investing in a particular cryptocurrency first thing that you need to consider is will other people start buying it at some point? This is exactly what drives prices up, and this is exactly what I’m going to try and do.

Part 2. Buying My First Crypto.

I’ve done a lot of research on ways of storing cryptocurrencies, and in my opinion the best and the safest way are hardware wallets. They’re those little specially-made devices with layers and layers of security measures built into them. I will invest in one of those once I’ve accumulated any substantial amount of crypto assets.

When it comes to Bitcoin, there are hundreds of wallets available: online, desktop, mobile, browser extensions, paper wallets and so on. Now, remember that this is your money and the whole idea of decentralised digital currencies was to give people full control of their finances. This is why I find the idea of using the centralised cryptocurrency exchanges ridiculous to say the least.

Just think about it: if you’re using an exchange to buy and store your crypto, you’re effectively giving full control of your assets to a third party. Why should you trust them, especially considering the amount of times crypto exchanges shut down or just ran away with their users’ money.

Also, it can take several days to register on an established exchange, depositing and withdrawing money also seems like one heck of a pain in the backside. Oh, and fees, transaction fees on everything. Having said that, I will explore exchanges at some point later on, just to get an understanding of how they work. For now, I’m steering clear though.

So, I had about $100 to spare, I wanted to spend them all on a single currency. I wanted to find a simple solution to storing most of my future digital assets, so I started looking and multi-currency wallets and two of them stood out: Jaxx and Exodus.

They’re actually very similar: both can hold multiple cryptocurrencies, both store all your private information on your device and not on their servers, both have crypto-exchanges integrated into them. Exodus has a nicer-looking design, Jaxx has a mobile app, which was the reason why I chose to try out Jaxx.

The set-up process was easy and super-intuitive. The app basically created a wallet for me, and further secured it with a 15-word recovery phrase. I used that phrase to link the desktop app with the mobile version so that I could use the wallet on the go.

So, I wanted to avoid exchanges and opted for a peer-to-peer exchange instead. There’s a service called LocalEthereum which facilitates just that - you can exchange your local currency for Ethereum at competitive rates, and the safety is ensured by smart contracts. So, no third parties involved. Seemed perfect, but this is what I was greeted with when trying to set up an account:

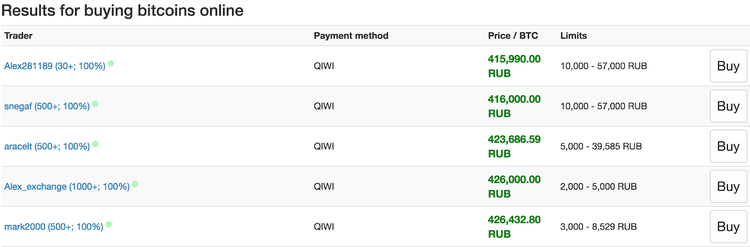

It just wouldn’t load, so opted for LocalBitcoins instead - similar concept, but instead of using smart contracts, the website provides an escrow service. I had my Russian rubles in a QIWI wallet, so I searched for an appropriate sellers and that’s what LocalBitcoins came up with:

The best rates were set for deals bigger than I intended to conduct, which is fair enough. I went for the third option. I got in touch with the seller, who responded within 5 minutes. 10 more minutes later, he confirmed that he received my payment, so LocalBitcoins released my purchase into my wallet on their website.

I immediately sent the entire amount to my newly set up main wallet, all I had to do is type in my wallet’s address (Jaxx shows it to you as soon as you open the app), the amount of BTCs I wanted to send and pay the 0.00005 BTC transaction fee. 7 minutes later I received my Bitcoins.

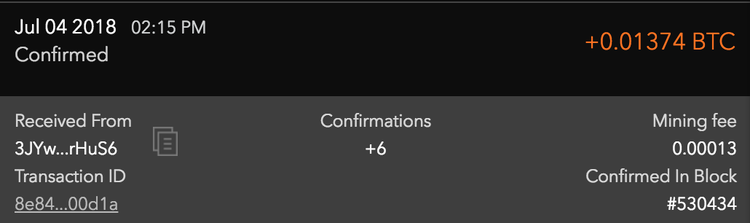

This is what the transaction looks like in Jaxx:

So, the mining fee was only 0.00013 which is about 80 cents. The entire process took no more than 20 minutes and I only paid $1.10 in fees.

Jaxx (just like any other wallet I imagine) also provides you with the Transaction ID which links you to a block explorer.

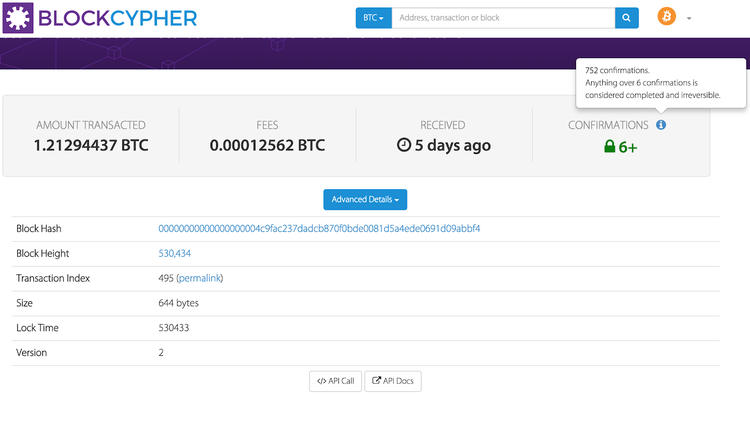

This is how my transaction was recorded on Bitcoin’s blockchain. My transaction, along with other 16 transactions, made up the block described in the picture above.

That super-long string of numbers and letters is the block’s hash. Hash is an output of a very complicated cryptographic equation, and the miners’ objective is to use their computing resources to try and find the input that produced this exact hash number. A miner that manages to solve a block receives all the fees as well as a reward which currently stands at 12.5 Bitcoins. Naturally, there’s a big competition, and the more computing power you have, the more chances of solving a block you have.

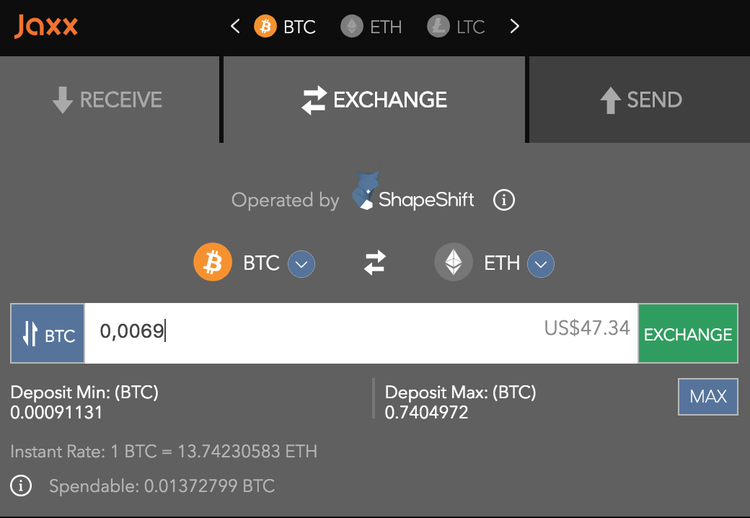

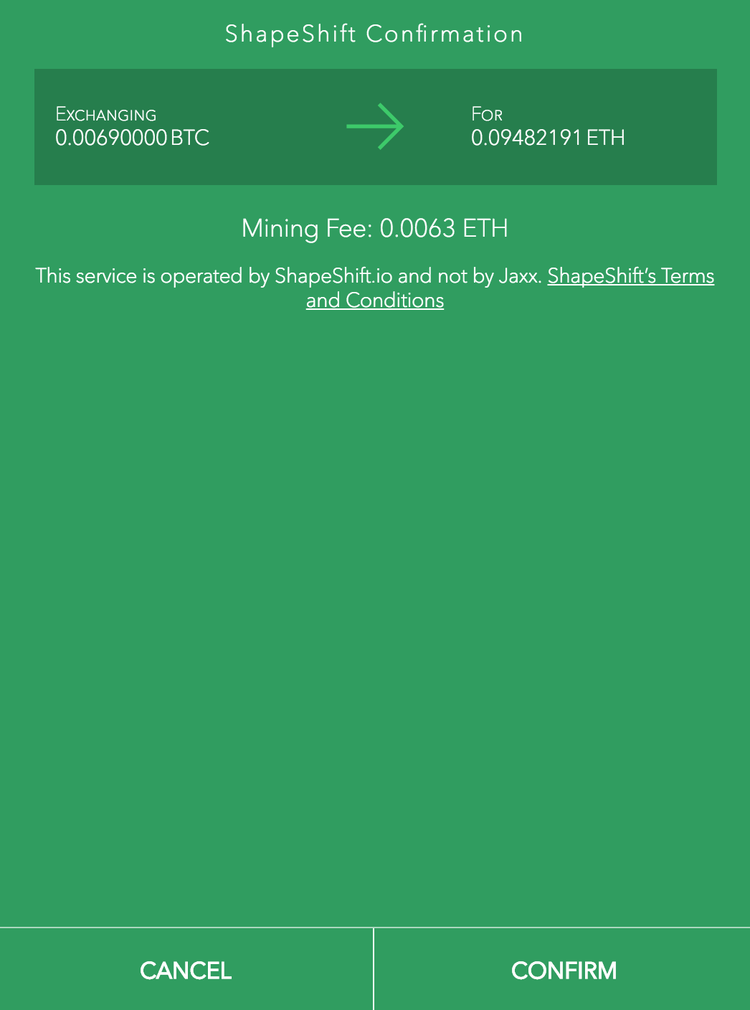

Now that I have some Bitcoins in my wallet, I wanted to test Shapeshift - an altcoin exchange integrated into Jaxx - and swap half of my Bitcoins for Ether. This also turned out to be super easy. I created an Ethereum wallet in Jaxx, pressed the ‘exchange’ button, filled in a couple of windows and that was it!

Shapeshift hold an inventory of coins and provide a fixed exchange rate, and it’s usually set around the actual trading price.

I swapped out 0,0069 BTC (because it’s a nice number) for almost 0.095 ETH. The mining fee was 0.0063 ETH, which is just under $3. That’s actually a lot.

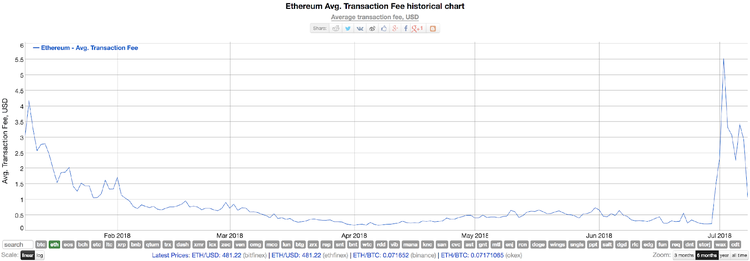

Trying to find out what happened, I had a look at the Ethereum average transaction fee chart and realized that I’ve managed to get my first ever Ether during the biggest spike that chart has ever seen, well done me!

Still, despite losing a bit of money on transaction fees, I’ve actually made a profit over this week. Both Bitcoin’s and Ether’s value fluctuates quite a bit, but on average I already have $5-7 more than I originally invested. I know it's ain't much, but it kind of makes me excited!

Next week, I’m going to look into Waves. I feel like this is the next logical step for me, as they have a decentralized crypto-exchange, a multi-asset wallet and a seemingly undervalued token. The project is in still in beta, but they’ve already held dozens of ICOs on the platform, only Ethereum had more. This, amongst other things, gives me reasons to believe that their token can go up in price at some point in the near future. Let’s investigate.