Technical analysis of the market from the crypto-currency broker AMarkets, partner Insider.pro.

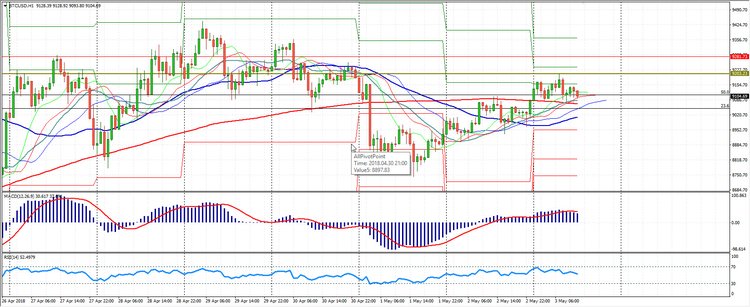

Bitcoin

Bitcoin prices stay flat within $9671-8575 range. The upper limit of this range is extremely important for market participants as moving beyond it will initiate a new bull rally which will subsequently update longterm highs. The opposite scenario would be breaking down below $8575. We will not look into this yet, as the first case is far more probable.

Earlier we had a pending order for $9000. It is now showing a small profit, but more would be better. There are signs that bitcoin will continue to grow, such as the price being above the fast and long moving averages, MACD above zero, and Fibo being at 50 providing local support. You can see a triangle pattern form on the hour timeframe from April 24. If the formation works out, we would expect BTC/USD to reach above $10000 in the coming days.

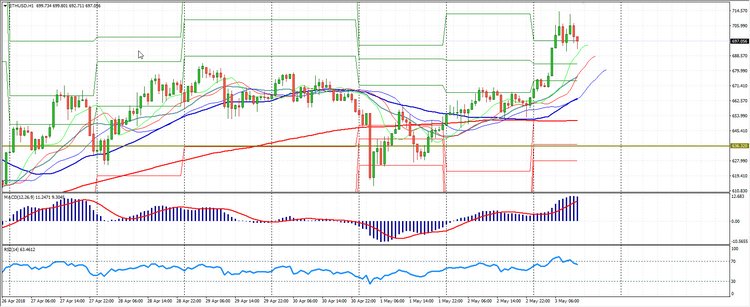

Dash

Dash is showing a similar pattern. We can see the same tapering triangle and equal potential for further growth. By 12:00 PM (MSK) the DSH/USD pair has adjusted to a 76.4 Fibo level, serving as the median function in the triangle. We recommend to move up the deferred level of Buy Limit placed previously at $420 closer to the lower border of the pattern at $440. We will start buying here in order to consolidate above $500.

The technical picture remains entirely on the buyers side. Even RSI, the traditional harbinger of trend’s reversal is now suggesting neutral pattern.

Ethereum

The dynamics of the Ethereum on Thursday trades is a clear example of how technical triangles and wedges develop. The ETH/USD pair successfully surpassed the higher point of the narrowing triangle and rode the growth impulse to quickly reach a resistant $700. We expect a similar scenario for Bitcoin and Dash.

As for the Ethereum, the long position opened earlier brings a solid profit of more than 10%. We recommend locking profits in by closing most of the position. For the remaining volume we will target above $1000. We assume that within the next few hours there can be a rollback, as suggested by overbought MACD and RSI. We do not consider short positions yet.