After Clinton entered the elections day yesterday with an 80% chance of winning, Trump's victory has taken everyone by surprise causing panic in the global markets.

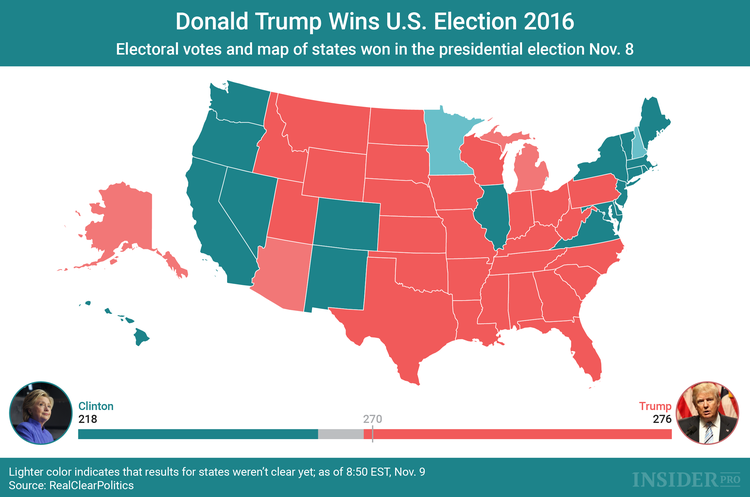

The Republican presidential candidate Donald Trump won the presidency shortly after midnight last night when he received 276 electoral votes out of 270 required ahead of Hillary Clinton, reported Associated Press. This was a very unexpected outcome, considering that Clinton had been heavily dominating the votings based on the polls and electoral forecasts up until yesterday. As soon as it became clear that Clinton's chances for the presidency are fading away, it sent shockwaves through financial markets in the U.S. and worldwide.

Futures had their worst day in months yesterday and were far more jumpy than during the previous presidential election. S&P 500 (INDEX: US500) futures lost over 97 points, or 4.6%, in the after-hours trading while Dow Jones (INDEX: DJI) futures plunged over 790 points, with Nasdaq (NASDAQ: COMP) futures down 220 point, or 4.5%. This market reaction is way too similar to Brexit craze back in June when the market was unprepared to face the results of the referendum, reported MarketWatch.

Brexit veterans will recognize the shape of tonight's Dow futures financial chart pic.twitter.com/wz0RUJtEbr

— Anthony Zurcher (@awzurcher) November 9, 2016

Next to the futures, Mexican peso (USD/MXN), the main indicator of Trump's success over the last months, hit its lowest level falling more than 13% last night to 20.30 pesos per dollar. Eventually, peso slightly recovered but it was still down 10% at 20.21, the lowest level since its worst fall during 1994 "Tequila Crisis", said Reuters. Mexico's central bank called for an emergency conference with the finance ministry today after experiencing such an adverse reaction of the country's national currency potentially dangerous for the economy. The fears of Mexico reflected in peso's performance got more real than ever as Trump called for a dissolution of the free trade agreement with Mexico as well as "building a wall" between the countries in his campaign statements. Even though peso lost against dollar, the U.S. currency was also down about 3%.

“Back in June, the markets had all but priced in a U.K. vote to remain in the EU, this time it was a similarly favorable market outcome that traders were banking on—a Clinton victory—and it seems that once again, they may have got it wildly wrong,” an analyst Craig Erlam told MarketWatch.

The Stoxx Europe 600 Index (STX: XX:SXXP) fell 0.4% after losing over 2% before, same with German and French equity indexes that lost about 2%, according to Bloomberg. Similar to the European ones, Asian stocks also significantly declined, with Hong Kong HSI index (INDEX: HSI) going down almost 3%, Nikkei 225 (IND: NKY) sliding 4% and Australian XAO index (ASX: AU: XAO) being off 2.4%. However, these losses were slightly compensated by a rally in health stocks that "celebrated" Clinton's loss amid speculations of forcing control in the industry and monitoring the drug prices.

Among health-care stocks, Mylan (NASDAQ: MYL) jumped at least 5.8%, Novartis AG (NYSE: NVS) and Roche Holding AG (SW: RO) were up about 3.4% and Sanofi (NYSE: SNY) grew by almost 3% after hours. In turn, gold (COMEX: GC) and U.S. Treasuries were in the spotlight last night as they had grown the most since the Brexit days, as investors fled to "safe" havens stocks, reports Bloomberg.

Market was expecting something else

The drop in the U.S. stock market today, if it holds long enough after the market opening, will wipe out the Dow Jones Monday rally on the news of FBI clearing the reopened investigation against Clinton. For the analysts, Dow Jones rally served as a sign that investors mostly bet on Clinton's victory yesterday as she was the one expected to bring less volatility into the markets being the "status quo" candidate, says the Wall Street Journal.

It appears that the main problem the stock market has with Trump is uncertainty around his claims and him as the next president, as he has never served in public or military services. Clinton, in turn, had a long record of serving as a senator and a secretary of state and was more specific in her campaign claims. The experts say that this "uncertainty" around Trump's persona is exactly what drove the markets crazy last night, with gold surging 5% thanks to its reputation of a "safe" stock. That also explains why some of the stocks recovered after the steep drop at night in the last hours, shortly after Donald Trump made his victory speech.

"I love this country. America will no longer settle for anything less than the best. We have a great economic plan, we will double our growth and have the strongest economy in the world," Trump said in his victory speech.

The immediate reaction of the market reflected the shockwave that hit the world when Donald Trump was announced to be the winner. However, it is still too early to say whether these market changes will stick around long enough, as no one is really sure which of his loud promises Trump will actually fulfil.