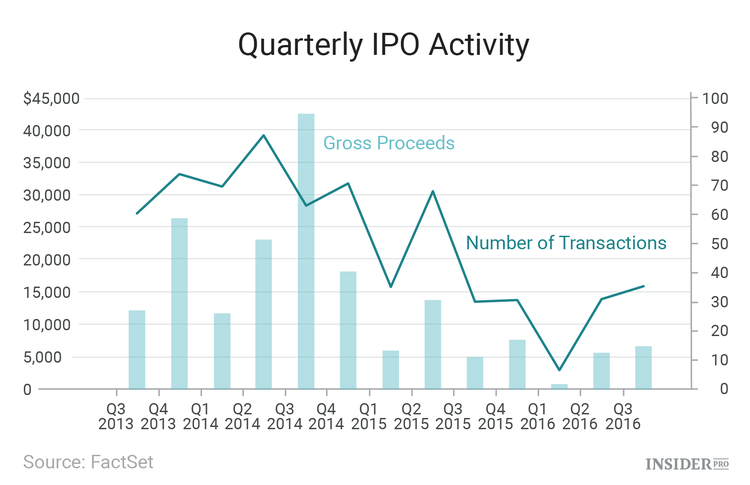

The number of companies going for an IPO is as low as in the post-crisis 2009. After reaching the rock-bottom level in Q1 of this year with zero Tech firms going public, the IPO volume doesn't seem to recover anytime soon.

A research analyst Andrew Birstingl has analyzed the number of completed IPOs as well as the amount of funds raised over the last few years and found out a quite distressing trend: 2016 is well on its way to become the worst year for IPOs since the 2008 crisis times.

Opening the year with less than 10 IPOs in a quarter, 2016 has proven to be a difficult year for companies to go public. Even though it is yet to see what Q4 will bring, 2016 is definitely on its way to officially become the worst year for IPOs since 2009. According to Birstingl, only 35 US companies have filed for an IPO this quarter, which is slightly better than the last year's Q3 result of 30 IPOs. However, there is a large 45% decline in the IPO volume between the first 3 quarters of 2015 and the same period of this year.

In the third quarter of 2016, the gross proceeds amounted to $6.7 billion, which is significantly lower than the the last years' average level of $10 billion, says Birstingl. Again, the total gross proceeds from the first 3 quarters of this year (about $13 billion) are the lowest since the post-crisis 2009 when the total amount of funds raised through IPOs in 3 quarters amounted to $9.4 billion. The overall 2016 gross proceedings are almost 48% lower than in the same period of the last year, says the analyst.

However, the sluggish IPO levels of 2009 could be easily explained by the big drop in all major stock indexes that year when the S&P 500 was at its lowest point of 666, explains the analyst John Burke. Yet this year, the situation is completely different. Only a few months ago, Dow Jones (INDEX: DIJA), S&P 500 (INDEX: US500) and Nasdaq Composite (NASDAQ: NDAQ) have reached their record-high levels, with S&P jumping to 2,185.79. This is a drastic difference from the 2009 levels, meaning that the stock market performance cannot directly explain the sluggish IPO enthusiasm of this year. Where is it coming from then?

IPO's risks seem higher than the gains

According to Burke, because of the weak IPO performance in the last 2 years, more and more companies are considering staying private longer. For the smaller companies IPO might often be a challenge distracting them from the long-term strategy as going public involves multiple responsibilities such as reporting to the U.S. Securities and Exchange Commission as well as pressures of sustaining the IPO stock prices that the companies seek to avoid. Instead, says the expert, private companies rely on the "pre-IPO" financing rounds that are much easier to implement than those happening after the official IPO.

Hosting several pre-IPO funding rounds allows the companies to grow their market cap and develop a growth strategy ahead of their IPO. Doing that often allows the companies to file for an IPO on completely different terms. This is one of the reasons that may explain the unprecedented decline in both the number of companies going public and the level of gross proceeds as more and more startups are delaying their IPO in order to cut costs.

Next to that, there is a JOBS Act of 2012 that allows the companies to have up to 2,000 shareholders before the company is obliged to share its financial statements. Previously, the number of allowed shareholders was 500, what also pushed companies to go public earlier. By increasing the number of shareholders in the pre-IPO stage, the government gave another opportunity for the companies to stay private longer and avoid the costs of public financial disclosures.

Tech IPOs are fading away

It is also essential to look at which sector produces the most new public companies in the period of overall decline. According to the experts, it is, hands down, healthcare. This quarter, out of the total of 35 IPOs, 11 came from this sector - the highest number of all industries. Birstingl says that the "Health Technology" group has been dominating the IPO volume already for 11 quarters in a row, leaving the previously hot Tech sector far behind. What is more, in the first (and the worst) quarter of 2016, there was officially no tech companies going public, reported CNN. Even though the Tech sector has been historically the most IPO-fruitful one both in terms of volume and the funds raised, it is not the same anymore.

"Companies and their bankers know that in this market, you'd have to take a pretty steep valuation cut to your public peers," Matt Kennedy, an analyst at Renaissance Capital told CNBC.

But it is the healthcare industry that stole the Tech's fame. Looking at the number of IPOs throughout this year, almost 50% of all IPOs originated from the health technology group that demonstrated a relatively equal distribution of Biotech companies as well as Pharmaceuticals within the group. But, despite the obvious domination of the sector, its current IPO volume is still far from that of the past 2 years. For example, in the first 3 quarters of 2014, 80 companies from the healthcare sector went public as compared to 30 firms this year.

The drastic slowdown in the Tech industry and in the overall IPO volume is definitely not something to ignore. The cautiousness of the new companies and of some of the "old" ones like Uber to go public might indicate the underlying market problems that are not so easy to spot.